Seagate 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

3. Impairment of Goodwill and Other Long-lived Assets (Continued)

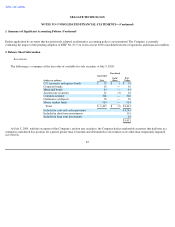

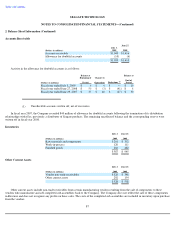

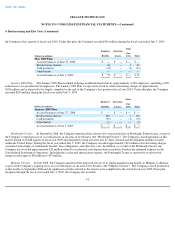

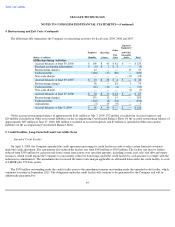

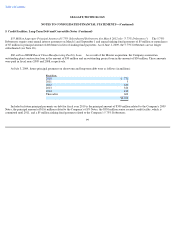

The changes in the carrying amount of goodwill by reporting units for fiscal year 2009 were as follows:

(1)

(Dollars in millions)

Hard Disk

Drive

Services

Total

Balance at June 27, 2008

$

2,169

$

183

$

2,352

Goodwill adjustments

(1)

(32

)

(2

)

(34

)

Impairment charges

(2,137

)

(150

)

(2,287

)

Balance at July 3, 2009

$

—

$

31

$

31

Goodwill adjustments during fiscal year 2009 primarily consisted of an aggregate $25 million reduction in unrecognized

tax benefits during the period, which was recorded as a reduction to goodwill in the first and second quarters.

In accordance with its policy, in the three months ended July 3, 2009, the Company performed an annual impairment review of the

remaining goodwill. The Company concluded the goodwill, which relates entirely to the Services reporting unit, was not impaired at July 3,

2009.

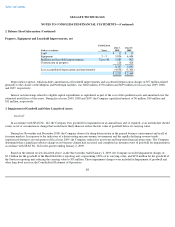

Other Long-lived Assets (Property, equipment, leasehold improvements, and other intangible assets)

In accordance with SFAS No. 144, the Company tests other long-lived assets, including property, equipment and leasehold improvements

and other intangible assets, subject to amortization, for recoverability whenever events or changes in circumstance indicate that their carrying

value may not be recoverable.

The Company determined that the adverse change in the business climate discussed under "Goodwill" above was also an indicator requiring

the testing of its other long-lived assets for recoverability and performed this test as of January 2, 2009. In accordance with the guidance in

SFAS No. 144, the Company determined that the asset group to be tested for recoverability was at the reporting unit level as it was the lowest

level at which cash flows were identifiable. The Company tested the other long-lived assets of both the Hard Disk Drive and Services reporting

units for recoverability and concluded that the carrying value of the Hard Disk Drive reporting unit was recoverable while that of the Services

reporting unit was not.

The Company recorded impairment charges of $3 million for the property and equipment and intangible assets of the Services reporting

unit during fiscal year 2009. The Company recorded these impairment charges in Impairment of goodwill and other long-lived assets in the

Consolidated Statement of Operations. No impairment charge was recorded for the intangible assets or Property, equipment and leasehold

improvements of the Hard Disk Drive reporting unit.

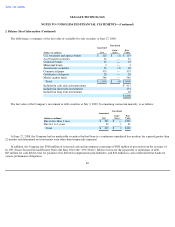

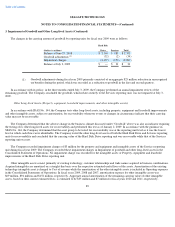

Other intangible assets consist primarily of existing technology, customer relationships and trade names acquired in business combinations.

Acquired intangibles are amortized on a straight-line basis over the respective estimated useful lives of the assets. Amortization of the existing

technology intangible asset is charged to Cost of revenue while the amortization of the other intangible assets is included in Operating expenses

in the Consolidated Statements of Operations. In fiscal years 2009, 2008 and 2007, amortization expense for other intangible assets was

$69 million, $94 million and $152 million, respectively. Aggregate annual amortization of the remaining carrying value of other intangible

assets, based on their current estimated lives, is estimated to be $35 million and $7 million for fiscal years 2010 and 2011, respectively.

89