Seagate 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

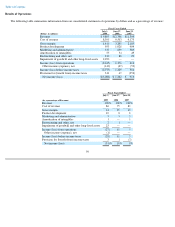

Dividends

On April 13, 2009, we announced that we adopted a policy of no longer paying a quarterly dividend to our common shareholders to

enhance liquidity. The suspension of paying quarterly dividends could cause the market price of our common shares to decline significantly and

our failure or inability to resume paying dividends at historical levels could result in a persistently low market valuation of our common shares.

Our ability to pay quarterly dividends in the future will be subject to, among other things, general business conditions within the disk drive

industry, our financial results, the impact of paying dividends on our credit ratings and legal and contractual restrictions on the payment of

dividends by our subsidiaries to us or by us to our common shareholders, including restrictions imposed by our amended credit facility and our

10% Notes. Specifically, under the terms and conditions of our recently amended credit agreement governing our credit facility we are restricted

from paying dividends in excess of $45 million, in the aggregate, during the period beginning on April 4, 2009 and ending on January 1, 2010

(inclusive), and in excess of $300 million, in the aggregate, during any period of four consecutive quarters thereafter until maturity of the credit

agreement. In addition, the indenture to our 10% Senior Secured Second-

Priority Notes due May 2014 have covenants that will be effective after

the maturity of the credit agreement. In addition, any payment of dividends to holders of our common shares in certain future quarters may result

in upward adjustments to the conversion rate of the 2.375% Convertible Senior Notes due August 2012.

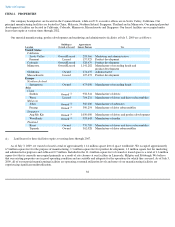

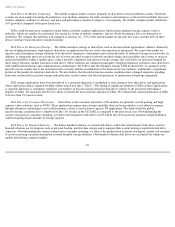

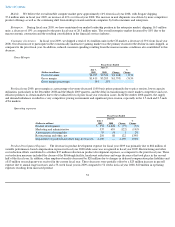

Since the closing of our initial public offering in December 2002 up to our policy change on April 13, 2009, we have paid dividends,

pursuant to our quarterly dividend policy then in effect, totaling approximately $952 million in the aggregate. The following are dividends paid

in the last two fiscal years:

For U.S. federal tax purposes, we had cumulative earnings and profits in excess of distributions for our taxable year ended July 3, 2009. As

a result, distributions on our common shares to U.S. shareholders during this period were treated as dividend income for U.S. federal income tax

purposes. Non-U.S. shareholders should consult with a tax advisor to determine appropriate tax treatment.

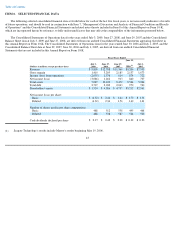

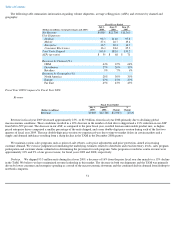

Repurchases of Our Equity Securities

We did not repurchase any of our common shares during the fiscal year ended July 3, 2009. As of July 3, 2009, we had authorization to

repurchase approximately $2.0 billion of our common shares remaining under the February 2008 stock repurchase plan, which expires February

2010.

42

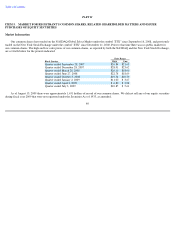

Record Date Paid Date

Dividend

per Share

August 3, 2007

August 17, 2007

$

0.10

November 2, 2007

November 16, 2007

$

0.10

February 1, 2008

February 15, 2008

$

0.10

May 2, 2008

May 16, 2008

$

0.12

August 1, 2008

August 15, 2008

$

0.12

November 7, 2008

November 21, 2008

$

0.12

February 6, 2009

February 20, 2009

$

0.03