Seagate 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

9. Shareholders' Equity (Continued)

shares. Holders of shares are entitled to one vote per share on all matters upon which the common shares are entitled to vote, including the

election of directors.

Preferred shares —The Company is authorized to issue up to a total of 100,000,000 preferred shares in one or more series, without

shareholder approval. The Board of Directors is authorized to establish from time to time the number of shares to be included in each series, and

to fix the rights, preferences and privileges of the shares of each wholly unissued series and any of its qualifications, limitations or restrictions.

The Board of Directors can also increase or decrease the number of shares of a series, but not below the number of shares of that series then

outstanding, without any further vote or action by the shareholders.

The Board of Directors may authorize the issuance of preferred shares with voting or conversion rights that could harm the voting power or

other rights of the holders of the common shares. The issuance of preferred shares, while providing flexibility in connection with possible

acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in control of

the Company and might harm the market price of its common shares and the voting and other rights of the holders of common shares. As of

July 3, 2009, there were no preferred shares outstanding.

Issuance of Common Shares

During fiscal year 2009, the Company issued approximately 2.9 million of its common shares from the exercise of stock options,

0.4 million nonvested shares, including performance shares, and approximately 4.8 million of its common shares related to the Company's

employee stock purchase plan.

Repurchases of Equity Securities

The Company did not repurchase any of its common shares during fiscal year 2009. As of July 3, 2009, the Company had approximately

$2.0 billion remaining under the authorized $2.5 billion February 2008 stock repurchase plan which expires February 2010.

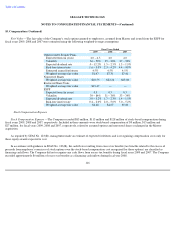

10. Compensation

Tax-Deferred Savings Plan

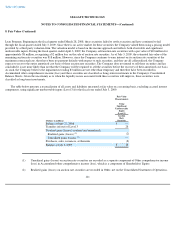

The Company has a tax-deferred savings plan, the Seagate 401(k) Plan (the "40l(k) plan"), for the benefit of qualified employees. The 40l

(k) plan is designed to provide employees with an accumulation of funds at retirement. Qualified employees may elect to make contributions to

the 401(k) plan on a monthly basis. Pursuant to the 401(k) plan, the Company matches 50% of employee contributions, up to 6% of

compensation, subject to maximum annual contributions of $2,500 per participating employee. During fiscal years 2009, 2008 and 2007, the

Company made matching contributions of $13 million, $15 million and $15 million, respectively.

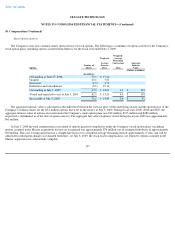

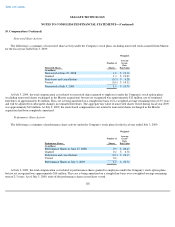

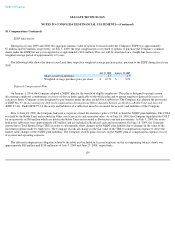

Stock-Based Benefit Plans

The Company's stock-based benefit plans have been established to promote the Company's long-term growth and financial success by

providing incentives to its employees, directors, and consultants through grants of share-based awards. The provisions of the Company's stock-

based benefit plans, which allow for the grant of various types of equity-based awards, are also intended to provide greater flexibility to

113