Seagate 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

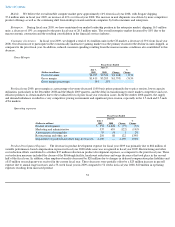

Disk Drives for Mobile Computing. The mobile compute market consists primarily of disk drives used in notebook systems. Notebook

systems are increasingly becoming the preference over desktop computers for both consumers and enterprises as the need for mobility increases,

wireless adoption continues to advance, and price and performance continue to improve. Consequently, the mobile compute market exhibited a

16% growth as compared to the prior fiscal year.

SSDs could become more competitive in the future in mobile compute applications which require minimal storage capacity such as

netbooks, which are smaller, less powerful, less expensive, forms of mobile computers, and are slowly becoming a low-cost alternative to

notebooks. We estimate that netbooks will comprise as much as 10 – 15% of the mobile market for the next few years, and that 80% of these

devices will have hard disk drives installed initially.

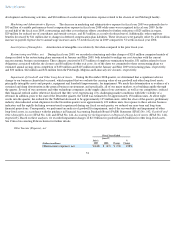

Disk Drives for Enterprise Storage. We define enterprise storage as disk drives used in mission critical applications, which is defined by

the use of high performance, high capacity disk drives in applications that are vital to the operation of enterprises. We expect the market for

mission critical enterprise storage solutions to be driven by enterprises continuing to move network traffic to dedicated storage area networks. In

addition, as enterprises move away from the use of server-attached storage to network-attached storage and consolidate data centers to increase

speed and reliability within a smaller space, reduce network complexity and increase energy savings, this will lead to an increased demand for

more energy efficient, smaller form factor disk drives. These solutions are comprised principally of high performance enterprise class disk drives

with sophisticated firmware and communications technologies. We believe that the enterprise storage TAM declined 18%, as compared to the

prior fiscal year, mainly due to the downturn in the economy and the consolidation in the financial services industry, traditionally a significant

portion of the market for enterprise disk drives. We also believe that the global macroeconomic conditions have changed enterprise spending

behaviors evidenced by increased storage utilization rates in data centers and deferred purchases of information technology equipment.

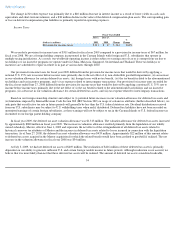

SSD storage applications have been introduced as a potential alternative to redundant system startup or boot disk drives and applications

where rapid processing is required for high volume transaction data ("Tier 0"). The timing of significant adoption of SSDs in these applications

is currently unknown as enterprises weigh the cost benefits of mission critical enterprise disk drives relative to the perceived performance

benefits of SSDs. We anticipate that Tier 0 is likely to benefit the most from the adoption of SSDs. We estimate the current penetration of SSDs

to be less than 1% based on units.

Disk Drives for Consumer Electronics. Disk drives in the consumer electronics (CE) markets are primarily used in gaming and high-

capacity video solutions, such as DVRs. These applications require more storage capability than can be provided in a cost-effective manner

through alternative technologies such as flash memory, which is used in lower capacity CE applications. We believe that the global

macroeconomic conditions have contributed to the 11% decline in the CE TAM, as compared to the prior fiscal year. Notwithstanding the

current contraction in consumer spending, we believe the demand for disk drives in CE will be driven by increased amounts of high definition

content requiring larger amounts of storage capacity.

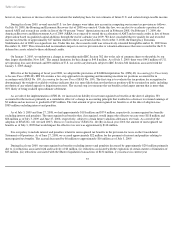

Disk Drives for Branded Solutions. We define branded solutions as external disk drives sold in the retail channel. Disk drives used in

branded solutions are for purposes such as personal backup, portable data storage and to augment their current desktop or notebook disk drive

capacities. Notwithstanding the current contraction in consumer spending, we believe the proliferation of media-

rich digital content will continue

to create increasing consumer demand for external branded storage solutions. Our branded solutions disk drives are accounted for within our

mobile and desktop compute markets.

46