Seagate 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

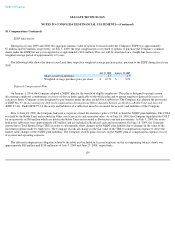

8. Fair Value (Continued)

Other Fair Value Disclosures

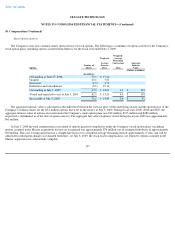

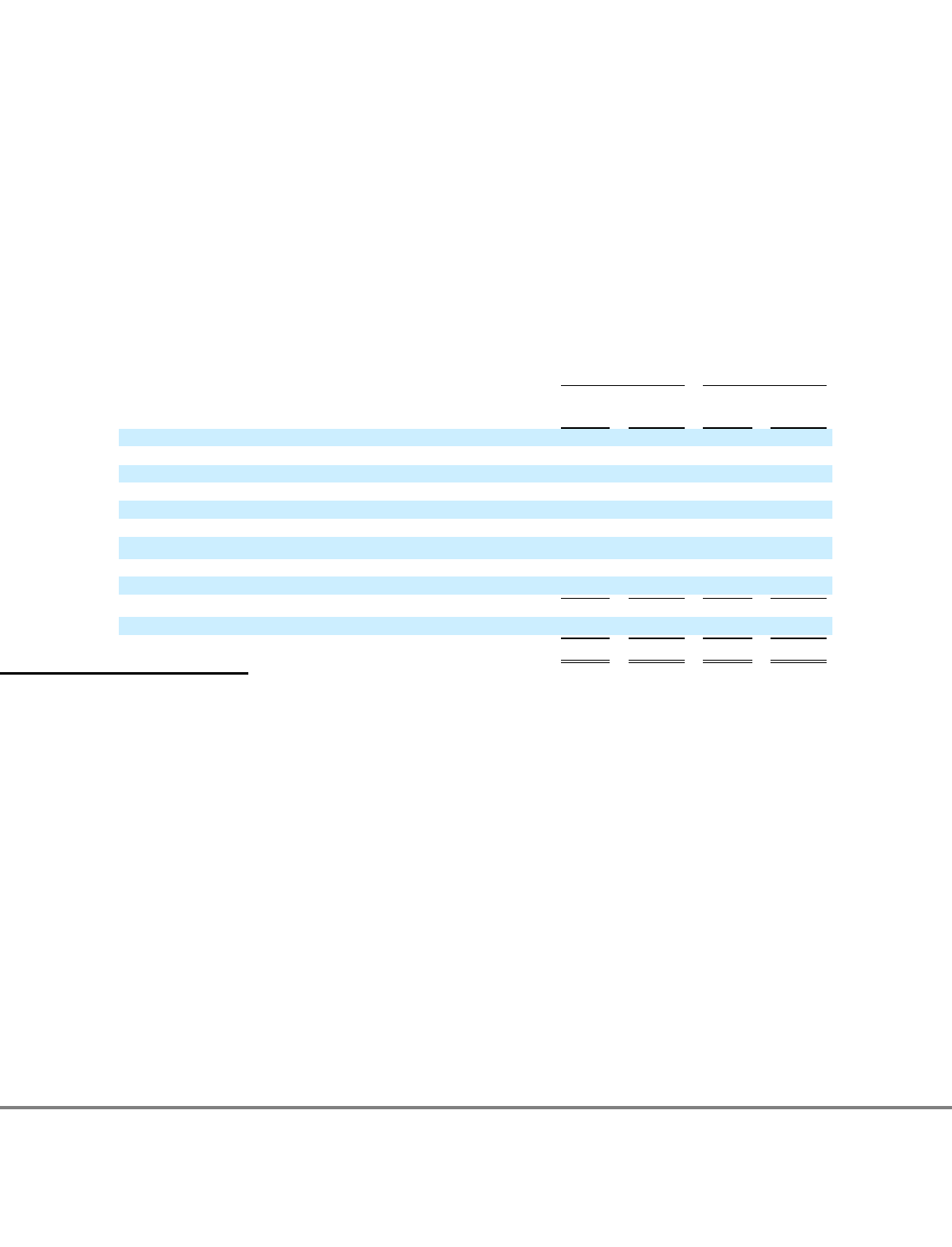

In accordance with SFAS No. 107, Disclosures about Fair Value of Financial Instruments , the Company is required to disclose the fair

value of its long-term debt at least annually or more frequently if the fair value has changed significantly.

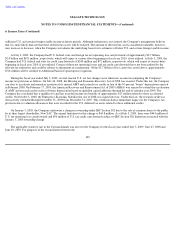

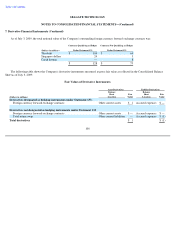

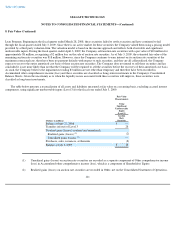

The Company's debt is carried at cost. The following table represents the fair value of the Company's debt in order of priority:

Reported as:

(1)

July 3, 2009

June 27, 2008

(Dollars in millions)

Carrying

Amount

Estimated

Fair Value

Carrying

Amount

Estimated

Fair Value

LIBOR Based Credit Facility

$

350

$

350

$

—

$

—

10.0% Senior Secured Second

-

Priority Notes due May 2014

410

445

—

—

Floating Rate Senior Notes due October 2009

300

299

300

293

6.8% Convertible Senior Notes due April 2010

116

116

135

142

6.375% Senior Notes due October 2011

599

581

599

584

5.75% Subordinated Debentures due March 2012

37

35

41

40

2.375% Convertible Senior Notes due August 2012

(1)

316

283

326

422

6.8% Senior Notes due October 2016

599

550

599

555

LIBOR Based China Manufacturing Facility Loans

—

—

30

30

2,727

2,659

2,030

2,066

Less short

-

term borrowings and current portion of long

-

term debt

(771

)

(769

)

(360

)

(457

)

Long

-

term debt, less current portion

$

1,956

$

1,890

$

1,670

$

1,609

Carrying amount of 2.375% Notes, net of debt discount as a result of the beneficial conversion feature. See Note 5, Credit Facilities,

Long-Term Debt and Convertible Notes for further discussion.

(2) The fair value of the Company's 2.375% and 6.8% convertible securities is a function, in part, of the Company's stock price. Because the

Company's stock price has decreased since June 27, 2008, the fair value of these securities has also decreased.

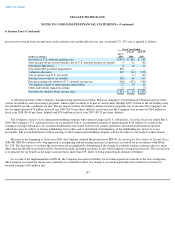

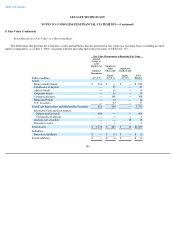

9. Shareholders' Equity

Share Capital

The Company's authorized share capital is $13,500 and consists of 1,250,000,000 common shares, par value $0.00001, of which

493,008,776 shares were outstanding as of July 3, 2009 and 100,000,000 preferred shares, par value $0.00001, of which none were issued or

outstanding as of July 3, 2009.

Common shares —Holders of common shares are entitled to receive dividends when and as declared by the Company's board of directors

(the "Board of Directors"). Upon any liquidation, dissolution, or winding up of the Company, after required payments are made to holders of

preferred shares, any remaining assets of the Company will be distributed ratably to holders of the preferred and common

112