Seagate 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We expect to pay cash restructuring charges aggregating approximately $70 million in the next 12 months primarily related to the

restructuring plans announced in January and May 2009. Additionally, in the next 12 months, we expect to pay an estimated $10 million in cash

restructuring charges related to the recent announcement of the closure of our Ang Mo Kio facility in Singapore.

During fiscal year 2009, we did not repurchase any of our common shares. As of July 3, 2009, we had authorization to repurchase

approximately $2.0 billion our common shares remaining under the February 2008 stock repurchase plan, which expires February 2010. See

Part II, Item 5: "Market for Registrant's Common Shares, Related Shareholder Matters and Issuer Purchases of Equity Securities—Repurchases

of Our Equity Securities."

We continue to evaluate various financing options to manage the retirement and replacement of existing debt and associated obligations,

including the issuance of new debt securities, exchanging existing debt securities for other debt securities and retiring debt pursuant to privately

negotiated transactions, open market purchases or otherwise. In addition, we may selectively pursue strategic alliances, acquisitions and

investments. Any material future acquisitions, alliances or investments will likely require additional capital.

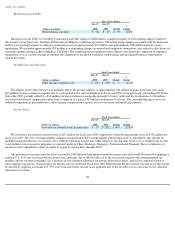

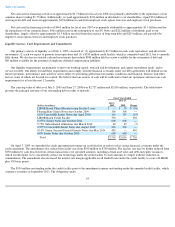

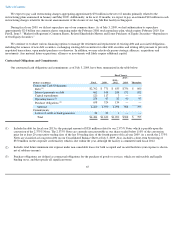

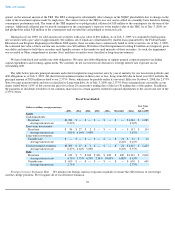

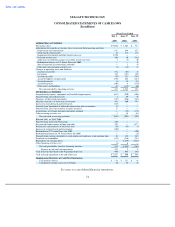

Contractual Obligations and Commitments

Our contractual cash obligations and commitments as of July 3, 2009, have been summarized in the table below:

(1)

Fiscal Year(s)

(Dollars in millions)

Total 2010 2011 –

2012

2013 –

2014

Thereafter

Contractual Cash Obligations:

Debt

(1)

$

2,762

$

771

$

635

$

756

$

600

Interest payments on debt

662

144

244

172

102

Capital expenditures

120

117

3

—

—

Operating leases

(2)

258

43

82

40

93

Purchase obligations

(3)

658

524

134

—

—

Subtotal

4,460

1,599

1,098

968

795

Commitments:

Letters of credit or bank guarantees

24

23

1

—

—

Total

$

4,484

$

1,622

$

1,099

$

968

$

795

Included in debt for fiscal year 2013 is the principal amount of $326 million related to our 2.375% Notes which is payable upon the

conversion of the 2.375% Notes. The 2.375% Notes are currently nonconvertible as our shares traded below 110% of the conversion

price for at least 20 consecutive trading days of the last 30 trading days of the fourth quarter of fiscal year 2009. As a result, the 2.375%

Notes are classified as Long-term debt on our Consolidated Balance Sheet at July 3, 2009. Also, includes a short-term borrowing of

$350 million on the corporate credit facility which is due within the year, although the facility is committed until fiscal 2012.

(2)

Includes total future minimum rent expense under non

-

cancelable leases for both occupied and vacated facilities (rent expense is shown

net of sublease income).

(3) Purchase obligations are defined as contractual obligations for the purchase of goods or services, which are enforceable and legally

binding on us, and that specify all significant terms.

65