Seagate 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

spread, on the notional amount of the TRS. The TRS is designed to substantially offset changes in the NQDC plan liability due to changes in the

value of the investment options made by employees. The contract term of the TRS is one year and is settled on a monthly basis therefore limiting

counterparty performance risk. The terms of the TRS required us to pledge initial collateral of $18 million to the counterparty for the term of the

contract. Additional collateral may be posted contingent on the counterparty's exposure to the market value of the TRS. As of July 3, 2009, we

had pledged the initial $18 million to the counterparty and recorded the cash pledged as restricted cash.

During fiscal year 2009, we sold auction rate securities with a par value of $10 million. As of July 3, 2009, we continued to hold auction

rate securities with a par value of approximately $21 million, all of which are collateralized by student loans guaranteed by the Federal Family

Education Loan Program. Beginning in the March 2008 quarter, these securities have continuously failed to settle at auction. As of July 3, 2009,

the estimated fair value of these auction rate securities was $18 million. We believe that the impairments totaling $3 million are temporary given

our ability and intent to hold these securities until liquidity returns to this market or until maturity of these securities. As such, the impairment

was recorded in Other comprehensive income (loss) and these securities were classified as long-term investments.

We have both fixed and variable rate debt obligations. We enter into debt obligations to support general corporate purposes including

capital expenditures and working capital needs. We currently do not use interest rate derivatives to hedge interest rate exposure on our

outstanding debt.

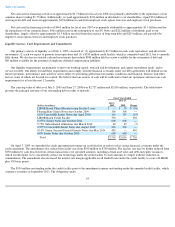

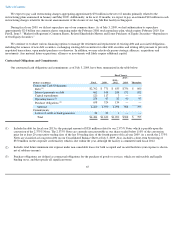

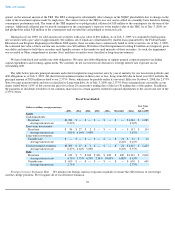

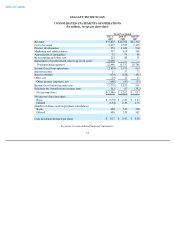

The table below presents principal amounts and related weighted average interest rates by year of maturity for our investment portfolio and

debt obligations as of July 3, 2009. All short-term investments mature in three years or less. Long-term debt due in fiscal year 2013 includes the

principal amount of $326 million related to our 2.375% Notes, which may be payable earlier if converted. Effective October 4, 2008, the 2.375%

Notes became nonconvertible and were reclassified to Long

-term debt. As of July 3, 2009, the 2.375% Notes remained non-convertible as our

shares traded below 110% of the conversion price for at least 20 consecutive trading days of the last 30 trading days of the quarter. In addition,

the payments of dividends to holders of our common shares have in certain quarters resulted in upward adjustments to the conversion rate of the

2.375% Notes.

Fiscal Years Ended

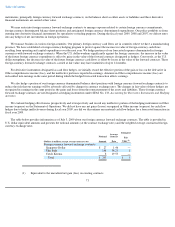

Foreign Currency Exchange Risk. We monitor our foreign currency exposures regularly to ensure the effectiveness of our foreign

currency hedge positions. We recognize all of our derivative financial

70

(Dollars in millions, except percentages)

2010

2011

2012

2013

2014

Thereafter

Total

Fair Value

at

July 3, 2009

Assets

Cash equivalents:

Fixed rate

$

1,281

$

—

$

—

$

—

$

—

$

—

$

1,281

$

1,281

Average interest rate

0.30

%

0.30

%

Short

-

term investments:

Fixed rate

$

84

$

27

$

2

$

—

$

—

$

—

$

113

$

114

Average interest rate

3.03

%

4.64

%

5.00

%

3.45

%

Long

-

term investments:

Variable rate

$

—

$

—

$

—

$

—

$

—

$

21

$

21

$

18

Average interest rate

0.22

%

0.22

%

Total investment securities

$

1,365

$

27

$

2

$

—

$

—

$

21

$

1,415

$

1,413

Average interest rate

0.47

%

4.64

%

5.00

%

0.22

%

0.55

%

Debt

Fixed rate

$

121

$

5

$

630

$

326

$

430

$

600

$

2,112

$

2,010

Average interest rate

6.76

%

5.75

%

6.35

%

2.38

%

10.00

%

6.80

%

6.63

%

Variable rate

$

650

$

—

$

—

$

—

$

—

$

—

$

650

$

649

Average interest rate

2.73

%

2.73

%