Seagate 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

8. Fair Value (Continued)

Loan Program. Beginning in the fiscal quarter ended March 28, 2008; these securities failed to settle at auction and have continued to fail

through the fiscal quarter ended July 3, 2009. Since there is no active market for these securities the Company valued them using a pricing model

provided by a third party valuation firm. The valuation model is based on the income approach and reflects both observable and significant

unobservable inputs. During the fiscal quarter ended April 3, 2009, the Company sold auction rate securities with a par value of $10 million for

approximately $8 million, recognizing a $2 million loss on the sale of auction rate securities. As of July 3, 2009, the estimated fair value of the

remaining auction rate securities was $18 million. However, since the Company continues to earn interest on its auction rate securities at the

maximum contractual rate, there have been no payment defaults with respect to such securities, and they are all collateralized, the Company

expects to recover the entire amortized cost basis of these auction rate securities. The Company does not intend to sell these securities and has

concluded it is not more likely than not that the Company will be required to sell the securities before the recovery of their amortized cost basis.

As such, the Company believes the impairments totaling $3 million are not other than temporary and therefore have been recorded in

Accumulated other comprehensive income (loss) and these securities are classified as Long-term investments in the Company's Consolidated

Balance Sheets. Given the uncertainty as to when the liquidity issues associated with these securities will improve, these securities were

classified as long-term investments.

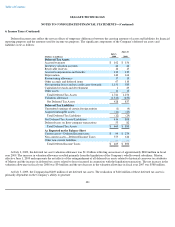

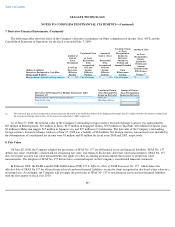

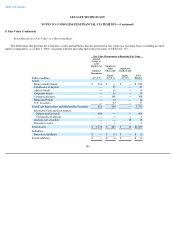

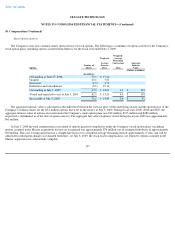

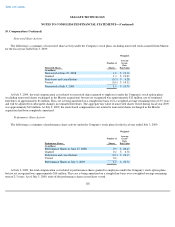

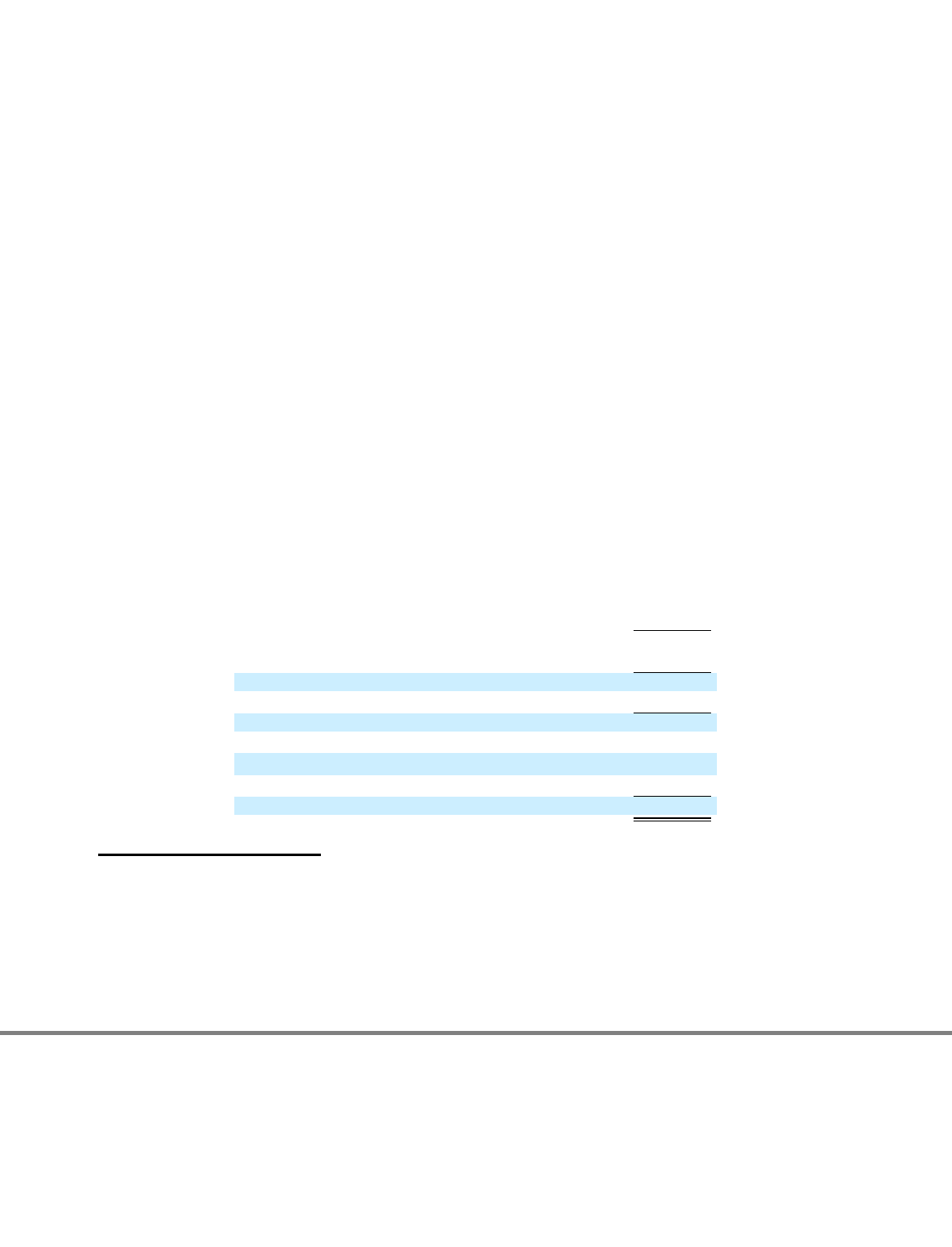

The table below presents a reconciliation of all assets and liabilities measured at fair value on a recurring basis, excluding accrued interest

components, using significant unobservable inputs (Level 3) for the fiscal year ended July 3, 2009:

(1)

Fair Value

Measurements

Using

Significant

Unobservable

Inputs

(Level 3)

(Dollars in millions)

Auction

Rate

Securities

Balance at June 27, 2008

$

—

Transfers in/(out) of Level 3

28

Total net gains (losses) (realized and unrealized):

Realized gains (losses)

(2)

(2

)

Unrealized gains (losses)

(1)

—

Purchases, sales, issuances, settlements

(8

)

Balance at July 3, 2009

$

18

Unrealized gains (losses) on auction rate securities are recorded as a separate component of Other comprehensive income

(loss) in Accumulated other comprehensive income (loss), which is a component of Shareholders' Equity.

(2) Realized gains (losses) on auction rate securities are recorded in Other, net on the Consolidated Statement of Operations.

111