Seagate 2008 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2008 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

7. Derivative Financial Instruments (Continued)

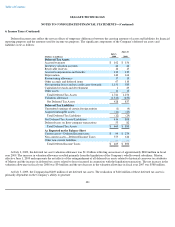

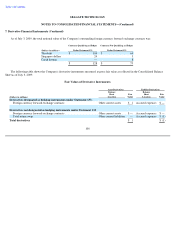

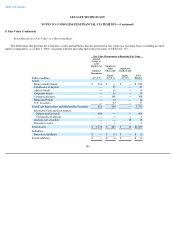

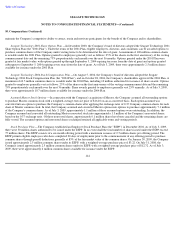

The following tables show the effect of the Company's derivative instruments on Other comprehensive income (loss) (OCI) and the

Consolidated Statement of Operations for the fiscal year ended July 3, 2009:

(a)

(Dollars in millions)

Derivatives Designated as Cash Flow

Hedges under FAS133

Amount of

Gain or

(Loss)

Recognized

in OCI on

Derivative

(Effective

Portion)

Location of Gain

or (Loss)

Reclassified

from

Accumulated

OCI into

Income

(Effective

Portion)

Amount of

Gain or (Loss)

Reclassified

from

Accumulated

OCI into

Income

(Effective

Portion)

Location of Gain

or (Loss)

Recognized in

Income on

Derivative

(Ineffective

Portion and

Amount Excluded

from

Effectiveness

Testing)

Amount of Gain

or (Loss)

Recognized in

Income

(Ineffective

Portion and

Amount

Excluded from

Effectiveness

Testing)

(a)

Foreign currency forward exchange contracts

$

(24

)

Cost of revenue

$

(36

)

Cost of revenue

$

(1

)

Derivatives Not Designated as Hedging Instruments under

Statement 133

Location of Gain or

(Loss) Recognized in

Income on Derivative

Amount of Gain or

(Loss) Recognized in

Income on Derivative

Foreign currency forward exchange contracts

Other, net

$

(18

)

Total return swap

Operating expenses

$

(1

)

$

(19

)

The amount of gain or (loss) recognized in income represents $0 related to the ineffective portion of the hedging relationships and $(1) million related to the amount excluded from

the assessment of hedge effectiveness, for the fiscal year ended July 3, 2009, respectively.

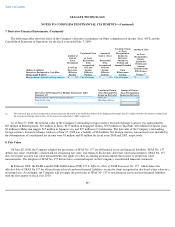

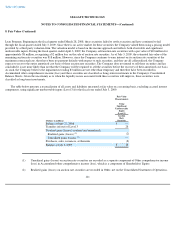

As of June 27, 2008, the notional value of the Company's outstanding foreign currency forward exchange contracts was approximately

$25 million in British pounds, $27 million in Euros, $115 million in Singapore dollars, $510 million in Thai baht, $20 million in Chinese yuan,

$2 million in Malaysian ringgit, $15 million in Japanese yen, and $15 million in Czech koruna. The fair value of the Company's outstanding

foreign currency forward exchange contracts at June 27, 2008 was a liability of $24 million. Net foreign currency transaction losses included in

the determination of consolidated net income were $1 million and $3 million for fiscal years 2008 and 2007, respectively.

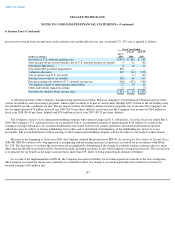

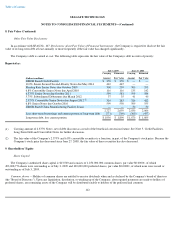

8. Fair Value

On June 28, 2008, the Company adopted the provisions of SFAS No. 157 for all financial assets and financial liabilities. SFAS No. 157

defines fair value, establishes a framework for measuring fair value, and enhances disclosures about fair value measurements. SFAS No. 157

does not require any new fair value measurements, but applies to other accounting pronouncements that require or permit fair value

measurements. The adoption of SFAS No. 157 did not have a material impact on the Company's consolidated financial statements.

In February 2008, the FASB issued FASB Staff Position (FSP) 157-2, Effective Date of FASB Statement No. 157 , which delays the

effective date of SFAS No.157 for all non-financial assets and non-

financial liabilities, except for items recognized or disclosed at fair value on a

recurring basis. Accordingly, the Company will not apply the provisions of SFAS No. 157 to non-financial assets and non-financial liabilities

until the first quarter of fiscal year 2010.

107