Seagate 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

2. Balance Sheet Information (Continued)

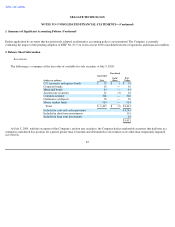

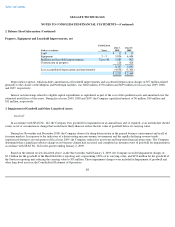

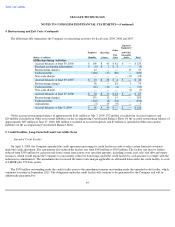

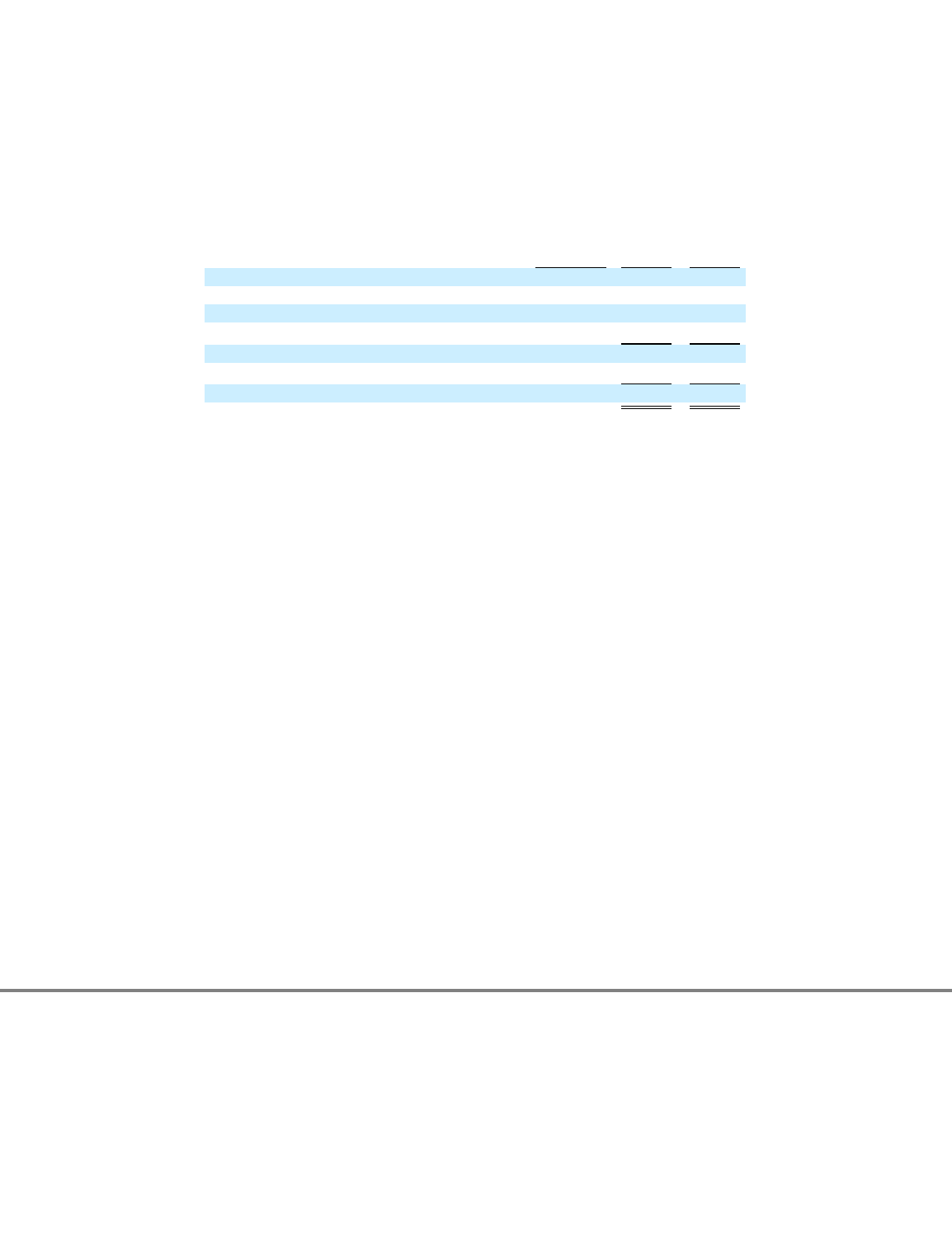

Property, Equipment and Leasehold Improvements, net

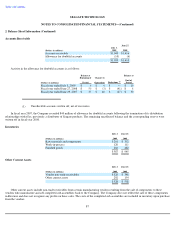

Depreciation expense, which includes amortization of leasehold improvements and accelerated depreciation charges of $57 million related

primarily to the closure of the Milpitas and Pittsburgh facilities, was $862 million, $750 million and $699 million for fiscal years 2009, 2008,

and 2007, respectively.

Interest on borrowings related to eligible capital expenditures is capitalized as part of the cost of the qualified assets and amortized over the

estimated useful lives of the assets. During fiscal years 2009, 2008 and 2007, the Company capitalized interest of $6 million, $10 million and

$11 million, respectively.

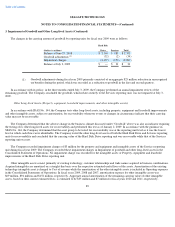

3. Impairment of Goodwill and Other Long-lived Assets

Goodwill

In accordance with SFAS No. 142, the Company tests goodwill for impairment on an annual basis and, if required, at an interim date should

events occur or circumstances change that would more likely than not reduce the fair value of goodwill below its carrying value.

During late November and December 2008, the Company observed a sharp deterioration in the general business environment and in all of

its major markets. In response to the indicators of a deteriorating macroeconomic environment and the rapidly declining revenue trends

experienced during its second quarter of fiscal year 2009, the Company reduced its near-term and long-term financial projections. The Company

determined that a significant adverse change in its business climate had occurred, and completed an interim review of goodwill for impairment in

accordance with SFAS No. 142 in the quarter ending January 2, 2009.

Based on the interim review described above, in the three months ended January 2, 2009, the Company recorded impairment charges of

$2.1 billion for the goodwill of the Hard Disk Drive reporting unit, representing 100% of its carrying value, and $150 million for the goodwill of

the Services reporting unit reducing the carrying value to $31 million. These impairment charges were included in Impairment of goodwill and

other long-lived assets in the Consolidated Statement of Operations.

88

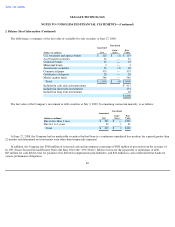

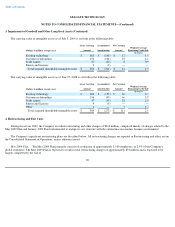

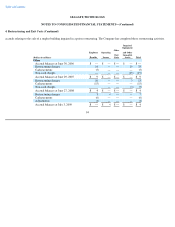

(Dollars in millions)

Useful Life in

Years July 3,

2009 June 27,

2008

Land

$

22

$

21

Equipment

3

–

5

5,034

4,404

Building and leasehold improvements

Up to 48

1,083

992

Construction in progress

128

428

6,267

5,845

Less accumulated depreciation and amortization

(4,038

)

(3,381

)

$

2,229

$

2,464