Seagate 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

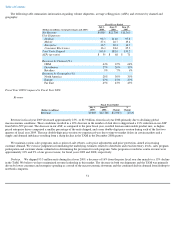

Industry Supply Balance

From time to time the industry has experienced periods of imbalances between supply and demand. In the December 2008 quarter, the

economic downturn created a sharp imbalance. As a result, the disk drive industry, including Seagate, adjusted production to realign to the lower

demand. The industry, as well as Seagate, exited the June 2009 quarter with what we believe to be approximately four weeks of distribution

channel inventory, which is at the low end of historical levels.

Fiscal Year 2009 Summary

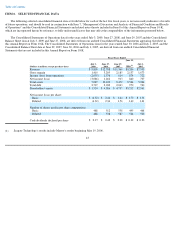

Our operating results for fiscal year 2009 were significantly impacted by the decline in the global macroeconomic environment. Revenues

for the fiscal year 2009 were $9.8 billion and gross margins were 14%, which represented a 23% decrease in revenues and a compression of our

gross margins by 1100 basis points when compared to the prior fiscal year.

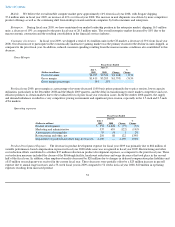

During the December 2008 quarter, we observed a sharp deterioration in the general business environment in all of our major markets and

we determined that a significant adverse change in our business climate had occurred. Consequently, we recorded impairment charges of

approximately $2.3 billion for goodwill. Additionally, in the December 2008 quarter, as part of our tax provision we recorded a $271 million

unfavorable adjustment to the valuation allowance related to our deferred tax assets.

In January 2009, we made substantial changes to our management team and began to implement organizational changes intended to

improve decision making, resource allocation and overall corporate performance. We also implemented actions directed at strengthening the

balance sheet and returning to profitability by improving our product competitiveness, realigning our cost structure to current economic

conditions and refinancing our debt.

Our fiscal year 2009 results were also impacted by the residual effects of our prior fiscal year's new product execution issues. In certain

markets, we experienced delays in transitioning to market competitive and more cost efficient products, which resulted in our losing time-to-

market leadership in these markets. We believe we have made significant progress in addressing our product time-to-market execution by the

end of the fiscal year 2009. The transition to more market competitive product offerings, which are also more cost effective, contributed to a

significant recovery in our gross margin in the June 2009 quarter, as compared to the immediately preceding quarter.

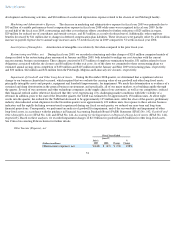

In addition, we implemented cost reduction activities that included completing the previously announced closures of our Milpitas media

manufacturing facility and our Pittsburgh research facility, reducing global workforce by approximately 5,500 employees, including over 25% of

our corporate officers and salary reductions for substantially all professional employees.

We also improved our liquidity position and capital structure by amending our credit facility to relax certain financial covenants, issuing

10% Notes in the aggregate principal amount of $430 million and improving working capital management.

49