Salesforce.com 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

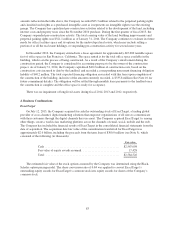

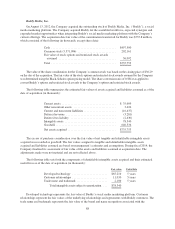

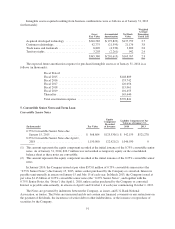

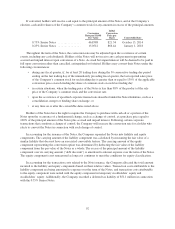

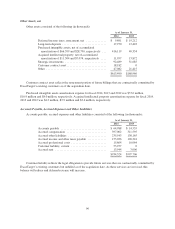

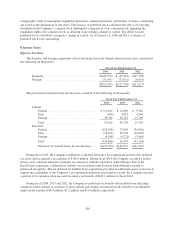

The Notes consisted of the following (in thousands):

As of January 31,

2014 2013

Liability component :

Principal:

0.75% Senior Notes (1) ..................... $ 568,864 $574,890

0.25% Senior Notes (1) ..................... 1,150,000 0

Less: debt discount, net

0.75% Senior Notes (2) ..................... (26,705) (53,612)

0.25% Senior Notes (3) ..................... (103,070) 0

Net carrying amount ............................ $1,589,089 $521,278

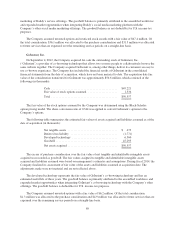

(1) The effective interest rates of the 0.75% Senior Notes and 0.25% Senior Notes are 5.86% and 2.53%,

respectively. These interest rates were based on the interest rates of a similar liability at the time of issuance

that did not have an associated convertible feature.

(2) Included in the consolidated balance sheets within Convertible 0.75% Senior Notes (which is classified as a

current liability, as these notes were convertible) and is amortized over the life of the 0.75% Senior Notes

using the effective interest rate method.

(3) Included in the consolidated balance sheets within Convertible 0.25% Senior Notes (which is classified as a

noncurrent liability) and is amortized over the life of the 0.25% Senior Notes using the effective interest rate

method.

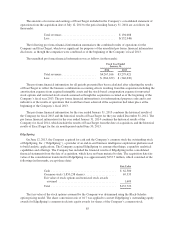

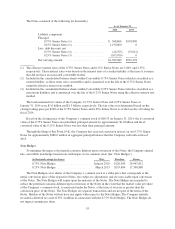

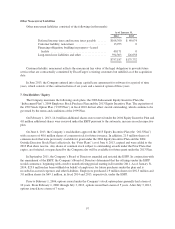

The total estimated fair values of the Company’s 0.75% Senior Notes and 0.25% Senior Notes at

January 31, 2014 were $1.6 billion and $1.3 billion, respectively. The fair value was determined based on the

closing trading price per $100 of the 0.75% Senior Notes and 0.25% Senior Notes as of the last day of trading for

fiscal 2014.

Based on the closing price of the Company’s common stock of $60.53 on January 31, 2014, the if-converted

value of the 0.75% Senior Notes exceeded their principal amount by approximately $1.0 billion and the if-

converted value of the 0.25% Senior Notes was less than their principal amount.

Through the filing of this Form 10-K, the Company has received conversion notices on our 0.75% Senior

Notes for approximately $280.0 million in aggregate principal balance that the Company will settle in fiscal

2015.

Note Hedges

To minimize the impact of potential economic dilution upon conversion of the Notes, the Company entered

into convertible note hedge transactions with respect to its common stock (the “Note Hedges”).

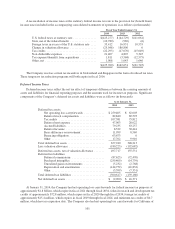

(in thousands, except for shares) Date Purchase Shares

0.75% Note Hedges ...................... January 2010 $126,500 26,943,812

0.25% Note Hedges ...................... March 2013 $153,800 17,308,880

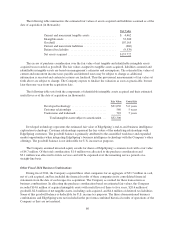

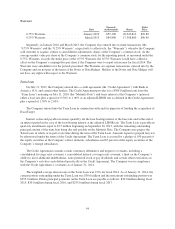

The Note Hedges cover shares of the Company’s common stock at a strike price that corresponds to the

initial conversion price of the respective Notes, also subject to adjustment, and are exercisable upon conversion

of the Notes. The Note Hedges will expire upon the maturity of the Notes. The Note Hedges are intended to

reduce the potential economic dilution upon conversion of the Notes in the event that the market value per share

of the Company’s common stock, as measured under the Notes, at the time of exercise is greater than the

conversion price of the Notes. The Note Hedges are separate transactions and are not part of the terms of the

Notes. Holders of the Notes will not have any rights with respect to the Note Hedges. The Company initially

recorded a deferred tax asset of $51.4 million in connection with the 0.75% Note Hedges. The Note Hedges do

not impact earnings per share.

93