Salesforce.com 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal Year 2013

Rypple

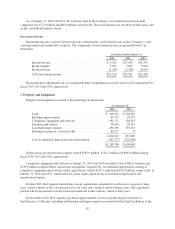

On February 1, 2012, the Company acquired for cash the outstanding stock of 2Catalyze, Inc., (“Rypple”), a

provider of social performance management applications. The Company acquired Rypple to, among other things,

enable customers to engage and align their employees and teams with a social performance management

solution, extending the employee social network to reach every employee. The Company has included the

financial results of Rypple in the consolidated financial statements from the date of acquisition, which have not

been material to date. The acquisition date fair value of the consideration transferred for Rypple was

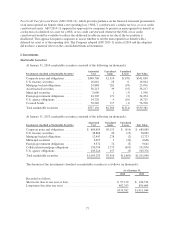

approximately $50.6 million, which consisted of the following (in thousands):

Cash ............................................. $50,166

Fair value of stock options assumed .................... 470

Total ............................................. $50,636

The fair value of the stock options assumed by the Company was determined using the Black-Scholes

option pricing model. The share conversion ratio of 0.044 was applied to convert Rypple options to the

Company’s options.

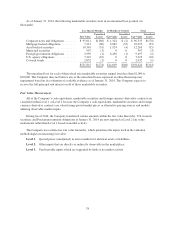

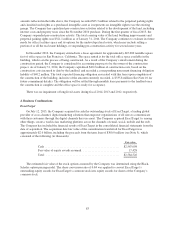

The following table summarizes the estimated fair values of assets acquired and liabilities assumed as of the

date of acquisition (in thousands):

Net tangible assets .................................. $ 758

Deferred tax liability ................................ (1,671)

Intangible assets .................................... 5,970

Goodwill .......................................... 45,579

Net assets acquired .................................. $50,636

The excess of purchase consideration over the fair value of net tangible and identifiable intangible assets

acquired was recorded as goodwill. The fair values assigned to tangible and identifiable intangible assets

acquired and liabilities assumed were based on management’s estimates and assumptions. During fiscal 2014, the

Company finalized its assessment of fair value of the assets and liabilities assumed at acquisition date. The

adjustments made were not material and are not reflected above.

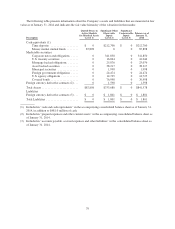

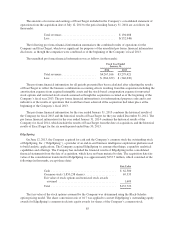

The following table sets forth the components of identifiable intangible assets acquired and their estimated

useful lives as of the date of acquisition (in thousands):

Fair value Useful Life

Developed technology ........................ $4,970 3 years

Customer relationships ........................ 1,000 1 year

Total intangible assets subject to amortization . . . $5,970

Developed technology represents the fair value of Rypple’s social performance management technology.

Customer relationships represent the fair values of the underlying relationships and agreements with Rypple

customers. The goodwill balance is primarily attributed to the assembled workforce and expanded market

opportunities when integrating Rypple’s social performance management technology with the Company’s other

offerings. The goodwill balance is deductible for U.S. income tax purposes.

The Company assumed unvested options with a fair value of $2.2 million. Of the total consideration,

$0.5 million was allocated to the purchase consideration and $1.7 million was allocated to future services that are

expensed over the remaining service periods on a straight-line basis.

87