Salesforce.com 2014 Annual Report Download - page 57

Download and view the complete annual report

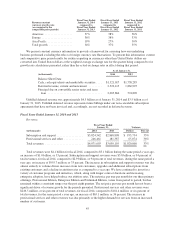

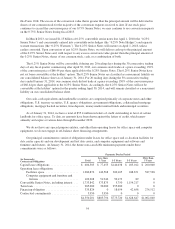

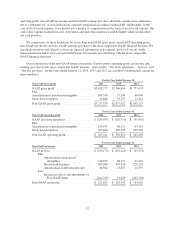

Please find page 57 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and other liabilities. Net cash provided by operating activities was also impacted by approximately $30.0 million

of payments made for the transaction fees incurred by ExactTarget and us related to the acquisition.

Net cash used in investing activities was $2.4 billion during fiscal 2014 and $938.9 million during the same

period a year ago. The net cash used in investing activities during fiscal 2014 primarily related to the acquisition

of EdgeSpring, Inc. (“EdgeSpring”) in June 2013, the acquisition of ExactTarget in July 2013, capital

expenditures, including new office build-outs and a new intellectual property licensing agreement, investment of

cash balances and strategic investments offset by proceeds from sales and maturities of marketable securities.

Net cash provided by financing activities was $1.6 billion during fiscal 2014 and $334.5 million during the

same period a year ago. Net cash provided by financing activities during fiscal 2014 consisted primarily of

$1.1 billion of proceeds from the issuance of convertible senior notes, $84.8 million from proceeds from the

issuance of warrants, $298.5 million of proceeds from the term loan, net of loan fees, and $289.9 million from

proceeds from employee-related equity plans offset by $153.8 million for the purchase of hedges on the

convertible note, $41.1 million of principal payments on capital leases and $15.0 million of principal payments

on the term loan.

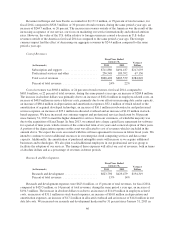

In July 2013, we entered into a credit agreement (the “Credit Agreement”) with Bank of America, N.A. and

certain other lenders, which provides for a $300.0 million term loan (the “Term Loan”) that matures on July 11,

2016 (the “Maturity Date”). The Term Loan bears interest at our option under either a LIBOR-based formula or a

base rate formula, each as set forth in the Credit Agreement.

The Credit Agreement contains certain customary affirmative and negative covenants, including a

consolidated leverage ratio covenant, a consolidated interest coverage ratio covenant, a limit on our ability to

incur additional indebtedness, issue preferred stock or pay dividends, and certain other restrictions on our

activities as defined in the Credit Agreement. We were in compliance with the Credit Agreement’s covenants as

of January 31, 2014.

The weighted average interest rate on the Term Loan was 2.0% for fiscal 2014. As of January 31 2014, the

amount outstanding under the Term Loan was $285.0 million. Accrued interest on the Term Loan was

$0.5 million as of January 31, 2014. During fiscal 2014, payments totaling $15.0 million were made on the Term

Loan and subsequent payments of $7.5 million are due quarterly thereafter until the maturity date in July 2016

when the remaining outstanding principal amount is due.

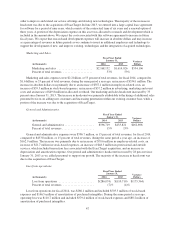

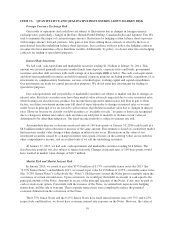

In January 2010, we issued $575.0 million of 0.75% convertible senior notes due January 15, 2015 (the

“0.75% Senior Notes”) and concurrently entered into convertible notes hedges (the “0.75% Note Hedges”) and

separate warrant transactions (the “0.75% Warrants”). The 0.75% Senior Notes will mature on January 15, 2015,

unless earlier converted. Upon conversion of any 0.75% Senior Notes, we will deliver cash up to the principal

amount of the 0.75% Senior Notes and, with respect to any excess conversion value greater than the principal

amount of the 0.75% Senior Notes, shares of our common stock, cash, or a combination of both.

For the 20 trading days during the 30 consecutive trading days ended October 31, 2013, our common stock

traded at a price exceeding 130% of the conversion price of $21.34 per share applicable to the 0.75% Senior

Notes. Accordingly, the 0.75% Senior Notes were convertible at the holders’ option for the quarter ending

January 31, 2014. For the 20 trading days during the 30 consecutive trading days ended January 31, 2014, our

common stock traded at a price exceeding 130% of the conversion price of $21.34 per share applicable to the

0.75% Senior Notes. Accordingly, the 0.75% Senior Notes are convertible at the holders’ option for the quarter

ending April 30, 2014. As the 0.75% Senior Notes are due on January 15, 2015, they are classified as a current

liability on our consolidated balance sheet as of January 31, 2014.

During the quarter ending April 30, 2014, we will repay in cash an aggregate principal balance of at least

$280.0 million related to conversion requests of our 0.75% Senior Notes received through the date of the filing of

53