Salesforce.com 2014 Annual Report Download - page 80

Download and view the complete annual report

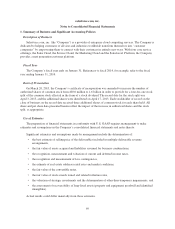

Please find page 80 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.available under the tax law. The Company regularly reviews the deferred tax assets for recoverability based on

historical taxable income, projected future taxable income, the expected timing of the reversals of existing

temporary differences and tax planning strategies. The Company’s judgments regarding future profitability may

change due to many factors, including future market conditions and the ability to successfully execute its

business plans and/or tax planning strategies. Should there be a change in the ability to recover deferred tax

assets, the tax provision would increase or decrease in the period in which the assessment is changed.

Foreign Currency Translation

The functional currency of the Company’s major foreign subsidiaries is generally the local currency.

Adjustments resulting from translating foreign functional currency financial statements into U.S. dollars are

recorded as a separate component on the consolidated statements of comprehensive loss. Foreign currency

transaction gains and losses are included in net loss for the period. All assets and liabilities denominated in a

foreign currency are translated into U.S. dollars at the exchange rate on the balance sheet date. Revenues and

expenses are translated at the average exchange rate during the period. Equity transactions are translated using

historical exchange rates.

Warranties and Indemnification

The Company’s enterprise cloud computing services are typically warranted to perform in a manner

consistent with general industry standards that are reasonably applicable and materially in accordance with the

Company’s online help documentation under normal use and circumstances.

The Company’s arrangements generally include certain provisions for indemnifying customers against

liabilities if its products or services infringe a third-party’s intellectual property rights. To date, the Company has

not incurred any material costs as a result of such obligations and has not accrued any liabilities related to such

obligations in the accompanying consolidated financial statements.

The Company has also agreed to indemnify its directors and executive officers for costs associated with any

fees, expenses, judgments, fines and settlement amounts incurred by any of these persons in any action or

proceeding to which any of those persons is, or is threatened to be, made a party by reason of the person’s service

as a director or officer, including any action by the Company, arising out of that person’s services as the

Company’s director or officer or that person’s services provided to any other company or enterprise at the

Company’s request. The Company maintains director and officer insurance coverage that would generally enable

the Company to recover a portion of any future amounts paid. The Company may also be subject to

indemnification obligations by law with respect to the actions of its employees under certain circumstances and

in certain jurisdictions.

New Accounting Pronouncements

In July 2012, the Financial Accounting Standards Board (the “FASB”) issued Accounting Standards Update

No. 2012-02, Intangibles—Goodwill and Other (Topic 350)—Testing Indefinite-Lived Intangible Assets for

Impairment (ASU 2012-02), to allow entities to use a qualitative approach to test indefinite-lived intangible

assets for impairment. ASU 2012-02 permits an entity to first perform a qualitative assessment to determine

whether it is more likely than not that the fair value of an indefinite-lived intangible asset is less than its carrying

value. If it is concluded that this is the case, it is necessary to perform the currently prescribed quantitative

impairment test by comparing the fair value of the indefinite-lived intangible asset with its carrying value.

Otherwise, the quantitative impairment test is not required. The Company adopted ASU 2012-02 in fiscal 2014.

The adoption did not have a material effect on the consolidated financial statements.

In July 2013, the FASB issued Accounting Standards Update No. 2013-11, Income Taxes (Topic 740):

Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a

76