Salesforce.com 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

this Form 10-K. The excess of the conversion value that is greater than the principal amount will be delivered in

shares of our common stock for the majority of the conversion requests received to date. If our stock price

continues to exceed the conversion price of our 0.75% Senior Notes, we may continue to see conversion requests

on the 0.75% Senior Notes during fiscal 2015.

In March 2013, we issued $1.15 billion of 0.25% convertible senior notes due April 1, 2018 (the “0.25%

Senior Notes”) and concurrently entered into convertible notes hedges (the “0.25% Note Hedges”) and separate

warrant transactions (the “0.25% Warrants”). The 0.25% Senior Notes will mature on April 1, 2018, unless

earlier converted. Upon conversion of any 0.25% Senior Notes, we will deliver cash up to the principal amount

of the 0.25% Senior Notes and, with respect to any excess conversion value greater than the principal amount of

the 0.25% Senior Notes, shares of our common stock, cash, or a combination of both.

The 0.25% Senior Notes will be convertible if during any 20 trading days during the 30 consecutive trading

days of any fiscal quarter commencing after April 30, 2013, our common stock trades at a price exceeding 130%

of the conversion price of $66.44 per share applicable to the 0.25% Senior Notes. The 0.25% Senior Notes have

not yet been convertible at the holders’ option. The 0.25% Senior Notes are classified as a noncurrent liability on

our consolidated balance sheet as of January 31, 2014. For 20 trading days during the 30 consecutive trading

days ended January 31, 2014, our common stock did not trade at a price exceeding 130% of the conversion price

of $66.44 per share applicable to the 0.25% Senior Notes. Accordingly, the 0.25% Senior Notes will not be

convertible at the holders’ option for the quarter ending April 30, 2014, and will remain classified as a noncurrent

liability on our consolidated balance sheet.

Our cash, cash equivalents and marketable securities are comprised primarily of corporate notes and other

obligations, U.S. treasury securities, U.S. agency obligations, government obligations, collateralized mortgage

obligations, mortgage backed securities, time deposits, money market mutual funds and municipal securities.

As of January 31, 2014, we have a total of $55.4 million in letters of credit outstanding in favor of certain

landlords for office space. To date, no amounts have been drawn against the letters of credit, which renew

annually and expire at various dates through December 2030.

We do not have any special purpose entities, and other than operating leases for office space and computer

equipment, we do not engage in off-balance sheet financing arrangements.

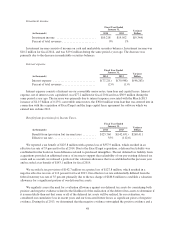

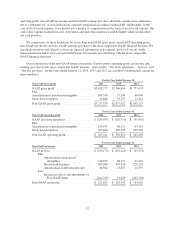

Our principal commitments consist of obligations under leases for office space and co-location facilities for

data center capacity and our development and test data center, and computer equipment and software and

furniture and fixtures. At January 31, 2014, the future non-cancelable minimum payments under these

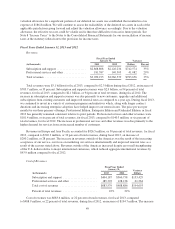

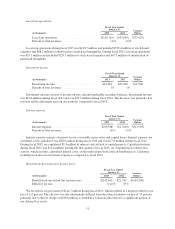

commitments were as follows:

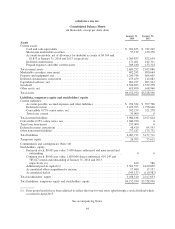

(in thousands)

Contractual Obligations

Payments Due by Period

Total

Less than

1 Year 1-3 Years 3-5 Years

More than

5 Years

Capital lease obligations ................... $ 606,505 $ 77,455 $146,038 $ 183,012 $ 200,000

Operating lease obligations:

Facilities space ...................... 1,280,872 144,568 300,105 248,671 587,528

Computer equipment and furniture and

fixtures ........................... 102,208 51,946 50,173 89 0

Convertible Senior Notes, including interest . . . 1,733,842 573,875 5,750 1,154,217 0

Term loan .............................. 285,000 30,000 255,000 0 0

Financing obligation ...................... 335,824 0 18,654 42,658 274,512

Contractual commitments .................. 5,950 5,950 0 0 0

$4,350,201 $883,794 $775,720 $1,628,647 $1,062,040

54