Salesforce.com 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

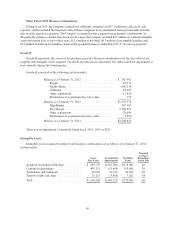

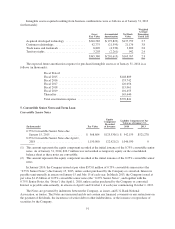

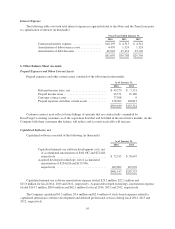

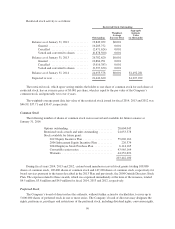

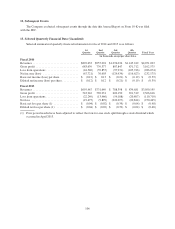

Other Noncurrent Liabilities

Other noncurrent liabilities consisted of the following (in thousands):

As of January 31,

2014 2013

Deferred income taxes and income taxes payable ...... $108,760 $ 49,074

Customer liability, noncurrent ..................... 13,953 0

Financing obligation, building in progress—leased

facility ...................................... 40,171 0

Long-term lease liabilities and other ................. 594,303 126,658

$757,187 $175,732

Customer liability, noncurrent reflects the noncurrent fair value of the legal obligation to provide future

services that are contractually committed by ExactTarget’s existing customers but unbilled as of the acquisition

date.

In June 2013, the Company entered into a large capital lease agreement for software for a period of nine

years, which consists of the contractual term of six years and a renewal option of three years.

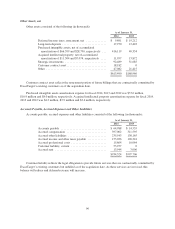

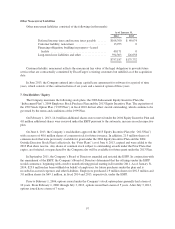

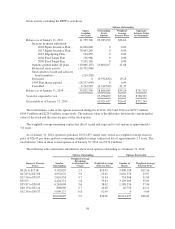

7. Stockholders’ Equity

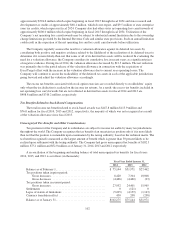

The Company maintains the following stock plans: the 2006 Inducement Equity Incentive Plan (the

“Inducement Plan”), 2004 Employee Stock Purchase Plan and the 2013 Equity Incentive Plan. The expiration of

the 1999 Stock Option Plan (“1999 Plan”) in fiscal 2010 did not affect awards outstanding, which continue to be

governed by the terms and conditions of the 1999 Plan.

On February 1, 2013, 14.0 million additional shares were reserved under the 2004 Equity Incentive Plan and

4.0 million additional shares were reserved under the ESPP pursuant to the automatic increase in each respective

plan.

On June 6, 2013, the Company’s stockholders approved the 2013 Equity Incentive Plan (the “2013 Plan”)

with a reserve of 48.0 million shares of common stock for future issuance. In addition, 21.9 million shares of

common stock that were previously available for grant under the 2004 Equity Incentive Plan and the 2004

Outside Directors Stock Plan (collectively, the “Prior Plans”) as of June 6, 2013, expired and were added to the

2013 Plan share reserve. Any shares of common stock subject to outstanding awards under the Prior Plans that

expire, are forfeited, or repurchased by the Company also will be available for future grant under the 2013 Plan.

In September 2011, the Company’s Board of Directors amended and restated the ESPP. In conjunction with

the amendment of the ESPP, the Company’s Board of Directors determined that the offerings under the ESPP

would commence, beginning with a twelve month offering period starting in December 2011. As of January 31,

2014, $23.9 million has been withheld on behalf of employees for future purchases under the plan and is

recorded in accrued expenses and other liabilities. Employees purchased 2.9 million shares for $92.5 million and

3.0 million shares for $69.1 million, in fiscal 2014 and 2013, respectively, under the ESPP.

Prior to February 1, 2006, options issued under the Company’s stock option plans generally had a term of

10 years. From February 1, 2006 through July 3, 2013, options issued had a term of 5 years. After July 3, 2013,

options issued have a term of 7 years.

97