Salesforce.com 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

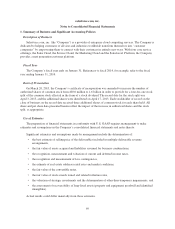

Tax Credit Carryforward Exists (ASU 2013-11), which provides guidance on the financial statement presentation

of an unrecognized tax benefit when a net operating loss (“NOL”) carryforward, a similar tax loss, or a tax credit

carryforward exists. ASU 2013-11 supports the approach for companies to present an unrecognized tax benefit as

a reduction of a deferred tax asset for a NOL or tax credit carryforward whenever the NOL or tax credit

carryforward would be available to reduce the additional taxable income or tax due if the tax position is

disallowed. This approach requires companies to assess whether to net the unrecognized tax benefit with a

deferred tax asset as of the reporting date. The Company adopted ASU 2013-11 in fiscal 2014 and the adoption

did not have a material effect on the consolidated financial statements.

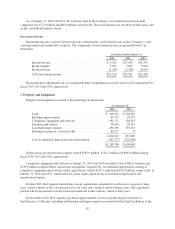

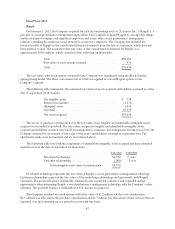

2. Investments

Marketable Securities

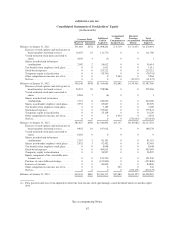

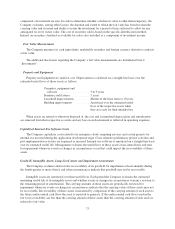

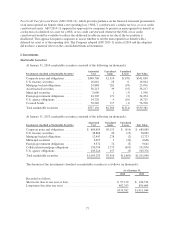

At January 31, 2014, marketable securities consisted of the following (in thousands):

Investments classified as Marketable Securities

Amortized

Cost

Unrealized

Gains

Unrealized

Losses Fair Value

Corporate notes and obligations ............ $340,706 $1,314 $(170) $341,850

U.S. treasury securities ................... 16,016 28 0 16,044

Mortgage backed obligations .............. 24,888 281 (93) 25,076

Asset backed securities ................... 38,213 39 (35) 38,217

Municipal securities ..................... 2,000 1 (3) 1,998

Foreign government obligations ............ 24,305 171 (2) 24,474

U.S. agency obligations .................. 14,726 9 (10) 14,725

Covered bonds .......................... 76,282 717 (1) 76,998

Total marketable securities ................ $537,136 $2,560 $(314) $539,382

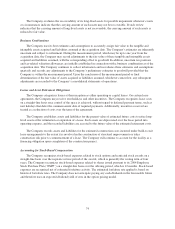

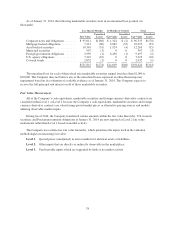

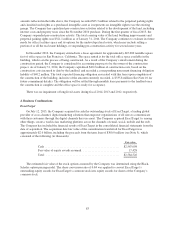

At January 31, 2013, marketable securities consisted of the following (in thousands):

Investments classified as Marketable Securities

Amortized

Cost

Unrealized

Gains

Unrealized

Losses Fair Value

Corporate notes and obligations ............ $ 685,695 $5,113 $ (919) $ 689,889

U.S. treasury securities ................... 38,864 20 (15) 38,869

Mortgage backed obligations .............. 12,447 278 (2) 12,723

Municipal securities ..................... 2,697 1 (32) 2,666

Foreign government obligations ............ 9,572 72 (3) 9,641

Collateralized mortgage obligations ......... 150,794 1,775 (693) 151,876

U.S. agency obligations ................... 105,224 157 (5) 105,376

Total marketable securities ................ $1,005,293 $7,416 $(1,669) $1,011,040

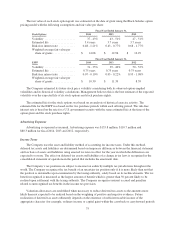

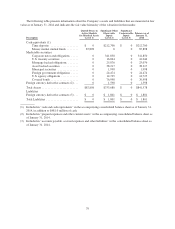

The duration of the investments classified as marketable securities is as follows (in thousands):

As of January 31,

2014 2013

Recorded as follows:

Short-term (due in one year or less) ............................. $ 57,139 $ 120,376

Long-term (due after one year) ................................ 482,243 890,664

$539,382 $1,011,040

77