Salesforce.com 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

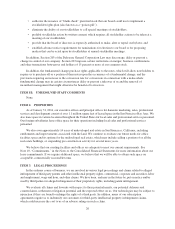

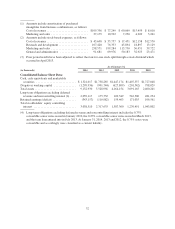

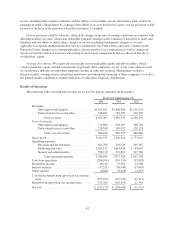

(1) Amounts include amortization of purchased

intangibles from business combinations, as follows:

Cost of revenues ............................ $109,356 $ 77,249 $ 60,069 $15,459 $ 8,010

Marketing and sales ......................... 37,179 10,922 7,250 4,209 3,241

(2) Amounts include stock-based expenses, as follows:

Cost of revenues ............................ $ 45,608 $ 33,757 $ 17,451 $12,158 $12,570

Research and development .................... 107,420 76,333 45,894 18,897 13,129

Marketing and sales ......................... 258,571 199,284 115,730 56,451 39,722

General and administrative ................... 91,681 69,976 50,183 32,923 23,471

(3) Prior period results have been adjusted to reflect the four-for-one stock split through a stock dividend which

occurred in April 2013.

As of January 31,

(in thousands) 2014 2013 2012 2011 2010

Consolidated Balance Sheet Data:

Cash, cash equivalents and marketable

securities ........................... $1,321,017 $1,758,285 $1,447,174 $1,407,557 $1,727,048

(Negative) working capital ............... (1,299,936) (901,744) (627,809) (201,542) 798,029

Total assets ............................ 9,152,930 5,528,956 4,164,154 3,091,165 2,460,201

Long-term obligations excluding deferred

revenue and noncontrolling interest (4) .... 2,059,117 175,732 109,349 516,506 481,234

Retained earnings (deficit) ................ (343,157) (110,982) 159,463 171,035 106,561

Total stockholders’ equity controlling

interest ............................. 3,038,510 2,317,633 1,587,360 1,276,491 1,043,802

(4) Long-term obligations excluding deferred revenue and noncontrolling interest includes the 0.75%

convertible senior notes issued in January 2010, the 0.25% convertible senior notes issued in March 2013,

and the term loan entered into in July 2013. At January 31, 2014, 2013 and 2012, the 0.75% notes were

convertible and accordingly were classified as a current liability.

32