Salesforce.com 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

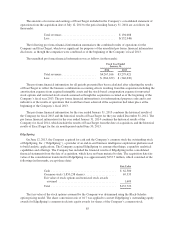

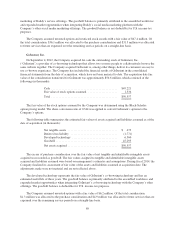

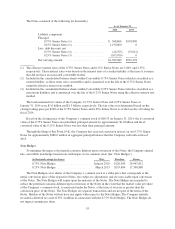

The amounts of revenue and earnings of ExactTarget included in the Company’s consolidated statement of

operations from the acquisition date of July 12, 2013 to the period ending January 31, 2014 are as follows (in

thousands):

Total revenues .................................... $194,008

Loss ............................................ $(152,948)

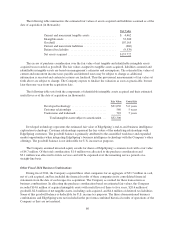

The following pro forma financial information summarizes the combined results of operations for the

Company and ExactTarget, which was significant for purposes of the unaudited pro forma financial information

disclosure, as though the companies were combined as of the beginning of the Company’s fiscal 2013.

The unaudited pro forma financial information was as follows (in thousands):

Fiscal Year Ended

January 31,

2014 2013

Total revenues ....................... $4,267,166 $3,279,421

Loss ............................... $ (364,659) $ (346,636)

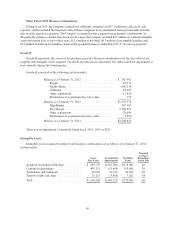

The pro forma financial information for all periods presented has been calculated after adjusting the results

of ExactTarget to reflect the business combination accounting effects resulting from this acquisition including the

amortization expense from acquired intangible assets and the stock-based compensation expense for unvested

stock options and restricted stock awards assumed as though the acquisition occurred as of the beginning of the

Company’s fiscal year 2013. The pro forma financial information is for informational purposes only and is not

indicative of the results of operations that would have been achieved if the acquisition had taken place at the

beginning of the Company’s fiscal 2013.

The pro forma financial information for the year ended January 31, 2013 combines the historical results of

the Company for fiscal 2013 and the historical results of ExactTarget for the year ended December 31, 2012. The

pro forma financial information for the year ended January 31, 2014 combines the historical results of the

Company for fiscal 2014, which include the results of ExactTarget from the date of acquisition, and the historical

results of ExactTarget for the six month period ended June 30, 2013.

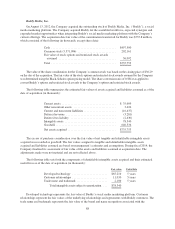

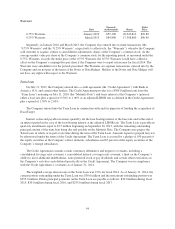

EdgeSpring

On June 12, 2013, the Company acquired for cash and the Company’s common stock the outstanding stock

of EdgeSpring, Inc. (“EdgeSpring”), a provider of an end-to-end business intelligence exploration platform used

to build analytic applications. The Company acquired EdgeSpring to, among other things, expand its analytical

capabilities and offerings. The Company has included the financial results of EdgeSpring in the consolidated

financial statements from the date of acquisition, which have not been material to date. The acquisition date fair

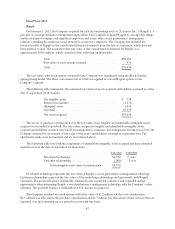

value of the consideration transferred for EdgeSpring was approximately $133.7 million, which consisted of the

following (in thousands, except share data):

Fair Value

Cash ............................................ $ 62,580

Common stock (1,850,258 shares) ..................... 69,533

Fair value of stock options and restricted stock awards

assumed ....................................... 1,609

Total ............................................ $133,722

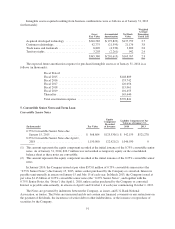

The fair value of the stock options assumed by the Company was determined using the Black-Scholes

option pricing model. The share conversion ratio of 0.17 was applied to convert EdgeSpring’s outstanding equity

awards for EdgeSpring’s common stock into equity awards for shares of the Company’s common stock.

85