Salesforce.com 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

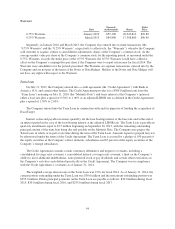

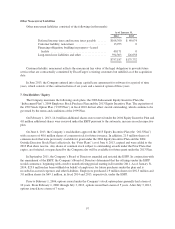

For fiscal 2014, 2013 and 2012 total unrecognized tax benefits in an amount of $34.9 million, $32.3 million,

and $39.1 million respectively, if recognized, would reduce income tax expense and the Company’s effective tax

rate after considering the impact of the change in valuation allowance in the U.S. since fiscal 2013.

The Company recognizes accrued interest and penalties related to unrecognized tax benefits in the income

tax provision. The Company accrued penalties and interest in the amount of $0.6 million, $0.3 million and $0.6

million in income tax expense during fiscal 2014, 2013 and 2012. The balance in the non-current income tax

payable related to penalties and interest was $3.3 million, $1.7 million and $1.4 million as of January 31, 2014,

2013 and 2012 respectively.

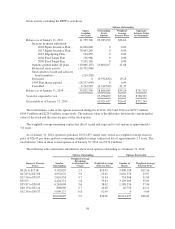

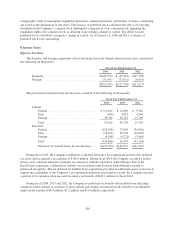

The Company has operations and taxable presence in multiple jurisdictions in the U.S. and outside of the

U.S. Tax positions for the Company and its subsidiaries are subject to income tax audits by multiple tax

jurisdictions around the world. The Company currently considers U.S. federal and state, Canada, Japan,

Germany, France and the United Kingdom to be major tax jurisdictions. The Company’s U.S. federal and state

tax returns since February 1999, which was the inception of the Company, remain open to examination. With

some exceptions, tax years prior to fiscal 2008 in jurisdictions outside of U.S. are generally closed. However, in

Japan and United Kingdom, the Company is no longer subject to examinations for years prior to fiscal 2009 and

fiscal 2011, respectively.

In fiscal 2014, the U.S. Internal Revenue Service and California Franchise Tax Board began its

examinations for the Company’s tax returns for the periods covering fiscal 2011 to 2012 and fiscal 2009 to 2010

respectively. The Company also has examinations in other international jurisdictions, including Canada, Japan,

Germany and the United Kingdom. The Company regularly evaluates its uncertain tax positions and the

likelihood of outcomes from these tax examinations. Significant judgment and estimates are necessary in the

determination of income tax reserves. Although it is often difficult to predict the outcomes of tax examinations,

the Company believes that it has provided adequate reserves for its income tax uncertainties. In the next twelve

months, the Company does not expect the unrecognized tax benefits balance to materially change due to the

uncertainty with these on-going examinations.

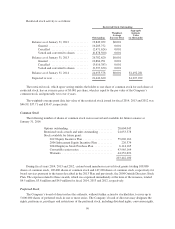

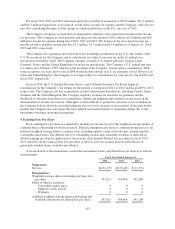

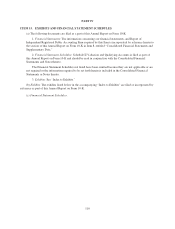

9. Earnings/Loss Per Share

Basic earnings/loss per share is computed by dividing net income (loss) by the weighted-average number of

common shares outstanding for the fiscal period. Diluted earnings/loss per share is computed giving effect to all

potential weighted average dilutive common stock, including options, restricted stock units, warrants and the

convertible senior notes. The dilutive effect of outstanding awards and convertible securities is reflected in

diluted earnings per share by application of the treasury stock method. Diluted loss per share for fiscal 2014,

2013 and 2012 are the same as basic loss per share as there is a net loss in these periods and inclusion of

potentially issuable shares would be anti-dilutive.

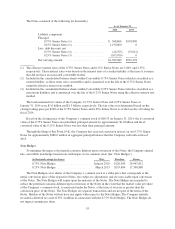

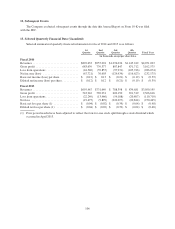

A reconciliation of the denominator used in the calculation of basic and diluted loss per share is as follows

(in thousands): Fiscal Year Ended January 31,

2014 2013 2012

Numerator:

Net loss ................................... $(232,175) $(270,445) $ (11,572)

Denominator:

Weighted-average shares outstanding for basic loss

per share ................................. 597,613 564,896 541,208

Effect of dilutive securities:

Convertible senior notes .................. 0 0 0

Employee stock awards ................... 0 0 0

Warrants ............................... 0 0 0

Adjusted weighted-average shares outstanding and

assumed conversions for diluted loss per share . . . 597,613 564,896 541,208

103