Salesforce.com 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

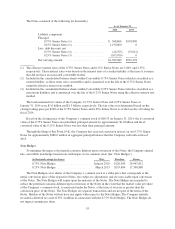

voting rights, terms of redemption, liquidation preference, sinking fund terms, and number of shares constituting

any series or the designation of any series. The issuance of preferred stock could have the effect of restricting

dividends on the Company’s common stock, diluting the voting power of its common stock, impairing the

liquidation rights of its common stock, or delaying or preventing a change in control. The ability to issue

preferred stock could delay or impede a change in control. As of January 31, 2014 and 2013, no shares of

preferred stock were outstanding.

8. Income Taxes

Effective Tax Rate

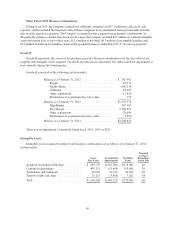

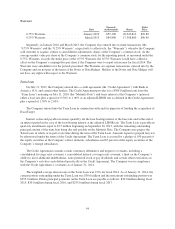

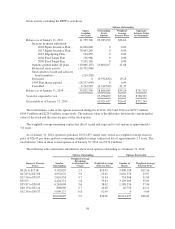

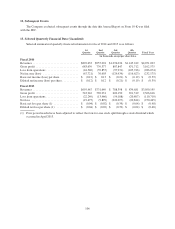

The domestic and foreign components of loss before provision for (benefit from) income taxes consisted of

the following (in thousands):

Fiscal Year Ended January 31,

2014 2013 2012

Domestic ................................... $(326,392) $ (90,743) $(27,303)

Foreign .................................... (31,543) (37,051) (6,014)

$(357,935) $(127,794) $(33,317)

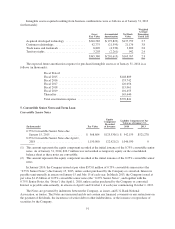

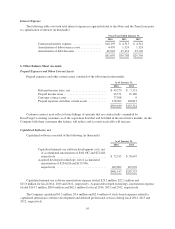

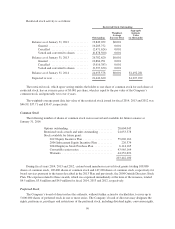

The provision for (benefit from) income taxes consisted of the following (in thousands):

Fiscal Year Ended January 31,

2014 2013 2012

Current:

Federal ................................. $ (10,431) $ 12,896 $ 9,344

State ................................... (245) 3,021 4,346

Foreign ................................. 39,784 30,261 15,709

Total ................................... 29,108 46,178 29,399

Deferred:

Federal ................................. (128,798) 72,656 (36,601)

State ................................... (22,012) 28,538 (10,603)

Foreign ................................. (4,058) (4,721) (3,940)

Total ................................... (154,868) 96,473 (51,144)

Provision for (benefit from) for income taxes . . . $(125,760) $142,651 $(21,745)

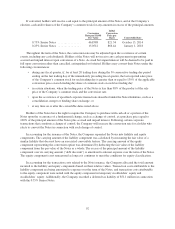

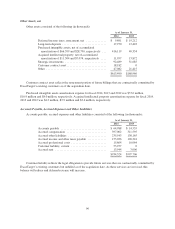

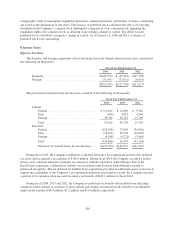

During fiscal 2013, the Company established a valuation allowance for a significant portion of its deferred

tax assets and recognized a tax expense of $186.8 million. During fiscal 2014, the Company recorded a partial

release of its valuation allowance primarily in connection with the acquisition of ExactTarget. Due to the

ExactTarget acquisition, a deferred tax liability was recorded for the book-tax basis difference related to

purchased intangibles. The net deferred tax liability from acquisitions provided an additional source of income to

support the realizability of the Company’s pre-existing deferred tax assets and as a result, the Company released

a portion of its valuation allowance and recorded a tax benefit of $143.1 million for fiscal 2014.

During fiscal 2014, 2013 and 2012, the Company recorded net tax benefits that resulted from allocating

certain tax effects related to exercises of stock options and vesting of restricted stocks directly to stockholders’

equity in the amount of $8.0 million, $7.2 million and $1.6 million, respectively.

100