Salesforce.com 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

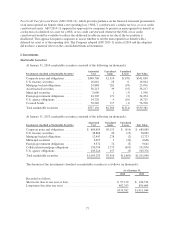

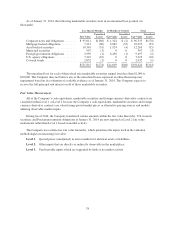

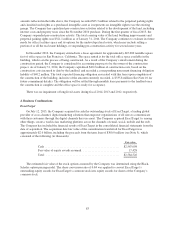

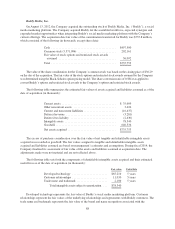

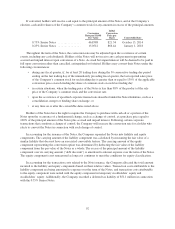

The following table summarizes the estimated fair values of assets acquired and liabilities assumed as of the

date of acquisition (in thousands):

Fair Value

Cash, cash equivalents and marketable securities ........ $ 91,549

Accounts receivable .............................. 63,320

Other current assets ............................... 20,355

Customer contract asset, current and noncurrent ........ 205,033

Property and equipment ........................... 64,782

Other noncurrent assets ............................ 4,379

Intangible assets ................................. 706,064

Goodwill ....................................... 1,848,653

Accounts payable, accrued expenses and other

liabilities ..................................... (65,636)

Deferred revenue, current and noncurrent ............. (46,615)

Customer liability, current and noncurrent ............. (144,792)

Other liabilities, noncurrent ........................ (3,104)

Deferred tax liability .............................. (159,462)

Net assets acquired ............................... $2,584,526

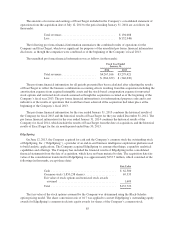

The excess of purchase consideration over the fair value of net tangible and identifiable intangible assets

acquired was recorded as goodwill. The fair values assigned to tangible and identifiable intangible assets

acquired and liabilities assumed are based on management’s estimates and assumptions. The deferred tax liability

established was primarily a result of the difference in the book basis and tax basis related to the identifiable

intangible assets. The estimated fair values of assets acquired and liabilities assumed, specifically current and

noncurrent income taxes payable and deferred taxes, may be subject to change as additional information is

received and certain tax returns are finalized. Thus the provisional measurements of fair value set forth above are

subject to change. The Company expects to finalize the valuation as soon as practicable, but not later than one-

year from the acquisition date.

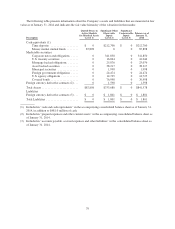

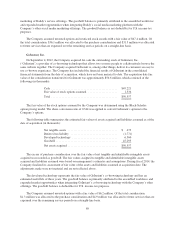

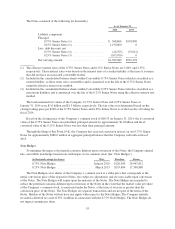

The following table sets forth the components of identifiable intangible assets acquired and their estimated

useful lives as of the date of acquisition (in thousands):

Fair Value Useful Life

Developed technologies .......................... $307,200 4 - 7 years

Customer relationships .......................... 362,200 6 - 8 years

Trade name and trademark ....................... 29,400 10 years

Other purchased intangible assets .................. 7,264 3 - 4 years

Total intangible assets subject to amortization .... $706,064

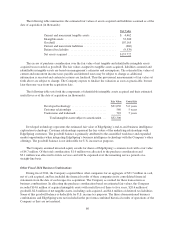

Developed technologies represent the estimated fair value of ExactTarget’s digital marketing technology.

Customer relationships represent the estimated fair values of the underlying relationships with ExactTarget

customers. The goodwill balance is primarily attributed to the assembled workforce and expanded market

opportunities when integrating ExactTarget’s digital marketing technology with the Company’s other offerings.

The goodwill balance is not deductible for U.S. income tax purposes.

The Company assumed unvested options and restricted stock with an estimated fair value of $102.2 million.

Of the total consideration, $17.4 million was allocated to the purchase consideration and $84.8 million was

allocated to future services and will be expensed over the remaining service periods on a straight-line basis.

84