Salesforce.com 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

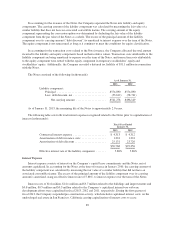

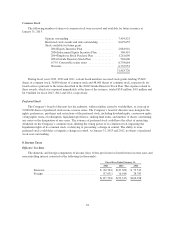

Common Stock

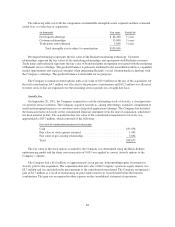

The following number of shares of common stock were reserved and available for future issuance at

January 31, 2013:

Options outstanding ............................... 7,495,823

Restricted stock awards and units outstanding .......... 6,695,655

Stock available for future grant:

2004 Equity Incentive Plan ..................... 2,084,916

2006 Inducement Equity Incentive Plan ........... 306,419

2004 Employee Stock Purchase Plan ............. 1,261,690

2004 Outside Directors Stock Plan ............... 548,600

0.75% Convertible senior notes ................. 6,734,664

Warrants ................................... 6,735,953

31,863,720

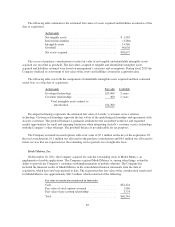

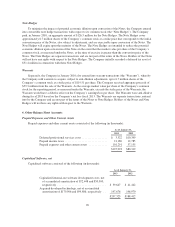

During fiscal years 2013, 2012 and 2011, certain board members received stock grants totaling 25,600

shares of common stock, 36,800 shares of common stock and 48,000 shares of common stock, respectively for

board services pursuant to the terms described in the 2004 Outside Directors Stock Plan. The expense related to

these awards, which was expensed immediately at the time of the issuance, totaled $3.8 million, $4.9 million and

$4.9 million for fiscal 2013, 2012 and 2011, respectively.

Preferred Stock

The Company’s board of directors has the authority, without further action by stockholders, to issue up to

5,000,000 shares of preferred stock in one or more series. The Company’s board of directors may designate the

rights, preferences, privileges and restrictions of the preferred stock, including dividend rights, conversion rights,

voting rights, terms of redemption, liquidation preference, sinking fund terms, and number of shares constituting

any series or the designation of any series. The issuance of preferred stock could have the effect of restricting

dividends on the Company’s common stock, diluting the voting power of its common stock, impairing the

liquidation rights of its common stock, or delaying or preventing a change in control. The ability to issue

preferred stock could delay or impede a change in control. At January 31, 2013 and 2012, no shares of preferred

stock were outstanding.

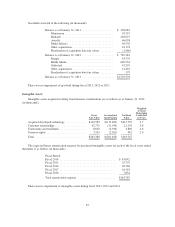

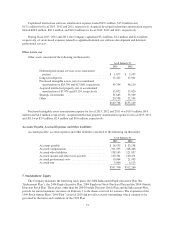

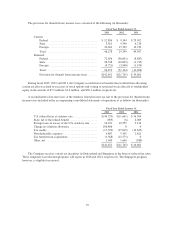

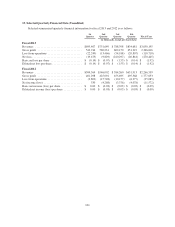

8. Income Taxes

Effective Tax Rate

The domestic and foreign components of income (loss) before provision for (benefit from) income taxes and

noncontrolling interest consisted of the following (in thousands):

Fiscal Year Ended January 31,

2013 2012 2011

Domestic ................................... $ (90,743) $(27,303) $ 75,515

Foreign ..................................... (37,051) (6,014) 28,783

$(127,794) $(33,317) $104,298

94