Salesforce.com 2013 Annual Report Download - page 58

Download and view the complete annual report

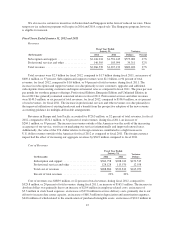

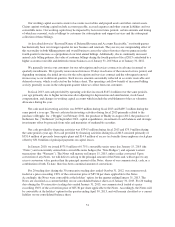

Please find page 58 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expense to establish a valuation allowance against a significant portion of those assets. The Company

applied significant judgment as part of this analysis including considering the Company’s past

operating results, cumulative losses and forecasts of future taxable income. As part of establishing a

valuation allowance with respect to the company’s deferred tax assets, the company will assess and

record any necessary quarterly changes to the valuation allowance and the corresponding income tax

expense or benefit. Management believes that the exclusion of this non-cash charge is appropriate to

provide investors with a better view of the company’s operational performance.

•Income Tax Effects and Adjustments. The Company’s non-GAAP tax provision excludes the tax effects

of expense items described above and certain tax items not directly related to the current fiscal year’s

ordinary operating results. Examples of such tax items include, but are not limited to, changes in the

valuation allowance related to deferred tax assets, certain acquisition-related costs and unusual or

infrequently occurring items. Management believes the exclusion of these income tax adjustments

provides investors with useful supplemental information about the Company’s operational performance

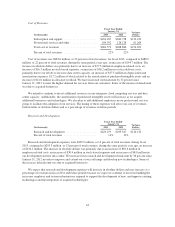

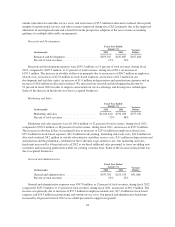

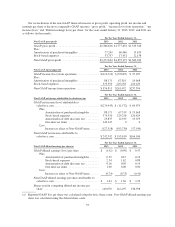

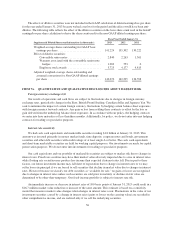

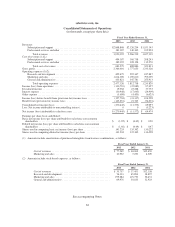

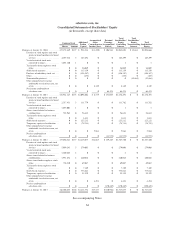

We define non-GAAP gross profit as our total revenues less cost of revenues, as reported on our

consolidated statement of operations, excluding the portions of stock-based expenses and amortization of

purchased intangibles that are included in cost of revenues.

We define non-GAAP operating profit as our non-GAAP gross profit less operating expenses, as reported

on our consolidated statement of operations, excluding the portions of stock-based expenses and amortization of

purchased intangibles that are included in operating expenses.

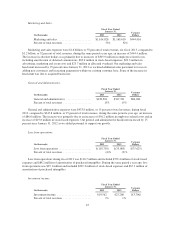

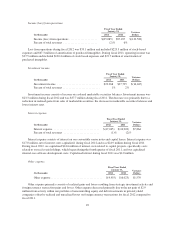

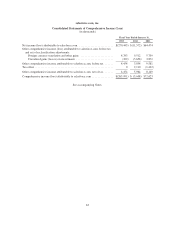

Non-GAAP earnings per share

Management uses the non-GAAP earnings per share to provide an additional view of performance by

excluding expenses that are not directly related to performance in any particular period in the earnings per share

calculation.

We define non-GAAP earnings per share as our non-GAAP net income, which excludes the above

components, which we believe are not reflective of our ongoing operational expenses, divided by basic or diluted

shares outstanding.

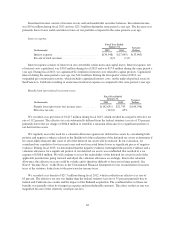

Limitations on the use of Non-GAAP financial measures

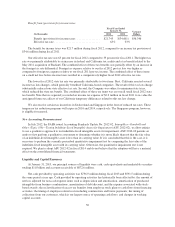

A limitation of our non-GAAP financial measures of non-GAAP gross profit, non-GAAP operating profit,

non-GAAP net income and non-GAAP earnings per share is that they do not have uniform definitions. Our

definitions will likely differ from the definitions used by other companies, including peer companies, and

therefore comparability may be limited. Thus, our non-GAAP measures of non-GAAP gross profit, non-GAAP

operating profit, non-GAAP net income and non-GAAP earnings per share should be considered in addition to,

not as a substitute for, or in isolation from, measures prepared in accordance with GAAP. Additionally, in the

case of stock-based expense, if we did not pay a portion of compensation in the form of stock-based expense, the

cash salary expense included in costs of revenues and operating expenses would be higher which would affect

our cash position.

We compensate for these limitations by reconciling non-GAAP gross profit, non-GAAP operating profit,

non-GAAP net income and non-GAAP earnings per share to the most comparable GAAP financial measure. We

encourage investors and others to review our financial information in its entirety, not to rely on any single

financial measure and to view our non-GAAP financial measures in conjunction with the most comparable

GAAP financial measures.

54