Salesforce.com 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

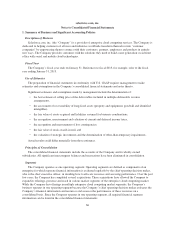

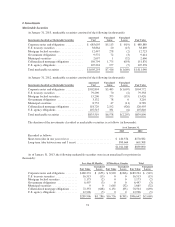

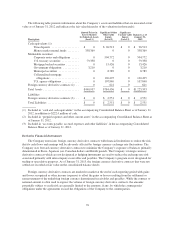

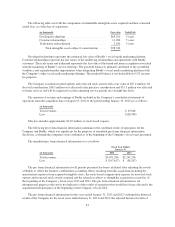

2. Investments

Marketable Securities

At January 31, 2013, marketable securities consisted of the following (in thousands):

Investments classified as Marketable Securities

Amortized

Cost

Unrealized

Gains

Unrealized

Losses Fair Value

Corporate notes and obligations ............ $ 685,695 $5,113 $ (919) $ 689,889

U.S. treasury securities ................... 38,864 20 (15) 38,869

Mortgage backed securities ................ 12,447 278 (2) 12,723

Government obligations .................. 9,572 72 (3) 9,641

Municipal securities ..................... 2,697 1 (32) 2,666

Collateralized mortgage obligations ......... 150,794 1,775 (693) 151,876

U.S. agency obligations ................... 105,224 157 (5) 105,376

Total marketable securities ................ $1,005,293 $7,416 $(1,669) $1,011,040

At January 31, 2012, marketable securities consisted of the following (in thousands):

Investments classified as Marketable Securities

Amortized

Cost

Unrealized

Gains

Unrealized

Losses Fair Value

Corporate notes and obligations ............ $502,894 $3,485 $(1,607) $504,772

U.S. treasury securities ................... 79,290 70 (2) 79,358

Mortgage backed securities ................ 15,206 375 (155) 15,426

Government obligations .................. 3,132 78 0 3,210

Municipal securities ..................... 8,753 47 (11) 8,789

Collateralized mortgage obligations ......... 118,729 2,192 (426) 120,495

U.S. agency obligations ................... 107,515 331 (6) 107,840

Total marketable securities ................ $835,519 $6,578 $(2,207) $839,890

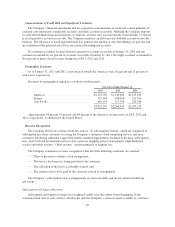

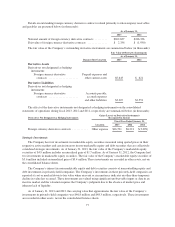

The duration of the investments classified as marketable securities is as follows (in thousands):

As of January 31,

2013 2012

Recorded as follows:

Short-term (due in one year or less) ............................. $ 120,376 $170,582

Long-term (due between one and 3 years) ........................ 890,664 669,308

$1,011,040 $839,890

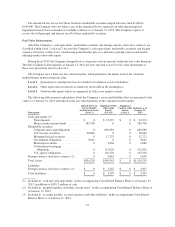

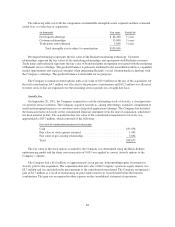

As of January 31, 2013, the following marketable securities were in an unrealized loss position (in

thousands):

Less than 12 Months 12 Months or Greater Total

Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses

Corporate notes and obligations ........ $180,374 $ (653) $ 8,920 $(266) $189,294 $ (919)

U.S. treasury securities ............... 16,513 (15) 0 0 16,513 (15)

Mortgage backed securities ............ 1,173 (2) 0 0 1,173 (2)

Government obligations .............. 6,497 (3) 0 0 6,497 (3)

Municipal securities ................. 0 0 1,665 (32) 1,665 (32)

Collateralized mortgage obligations ..... 72,353 (608) 6,151 (85) 78,504 (693)

U.S. agency obligations ............... 12,996 (5) 0 0 12,996 (5)

$289,906 $(1,286) $16,736 $(383) $306,642 $(1,669)

74