Salesforce.com 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note Hedges

To minimize the impact of potential economic dilution upon conversion of the Notes, the Company entered

into convertible note hedge transactions with respect to its common stock (the “Note Hedges”). The Company

paid, in January 2010, an aggregate amount of $126.5 million for the Note Hedges. The Note Hedges cover

approximately 6.7 million shares of the Company’s common stock at a strike price that corresponds to the initial

conversion price of the Notes, also subject to adjustment, and are exercisable upon conversion of the Notes. The

Note Hedges will expire upon the maturity of the Notes. The Note Hedges are intended to reduce the potential

economic dilution upon conversion of the Notes in the event that the market value per share of the Company’s

common stock, as measured under the Notes, at the time of exercise is greater than the conversion price of the

Notes. The Note Hedges are separate transactions and are not part of the terms of the Notes. Holders of the Notes

will not have any rights with respect to the Note Hedges. The Company initially recorded a deferred tax asset of

$51.4 million in connection with these Note Hedges.

Warrants

Separately, the Company in January 2010 also entered into warrant transactions (the “Warrants”), whereby

the Company sold warrants to acquire, subject to anti-dilution adjustments, up to 6.7 million shares of the

Company’s common stock at a strike price of $119.51 per share. The Company received aggregate proceeds of

$59.3 million from the sale of the Warrants. As the average market value per share of the Company’s common

stock for the reporting period, as measured under the Warrants, exceeds the strike price of the Warrants, the

Warrants would have a dilutive effect on the Company’s earnings/loss per share. The Warrants were anti-dilutive

during fiscal 2013 based on the Company’s net loss fiscal 2013. The Warrants are separate transactions, entered

into by the Company and are not part of the terms of the Notes or Note Hedges. Holders of the Notes and Note

Hedges will not have any rights with respect to the Warrants.

6. Other Balance Sheet Accounts

Prepaid Expenses and Other Current Assets

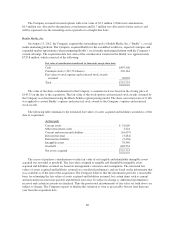

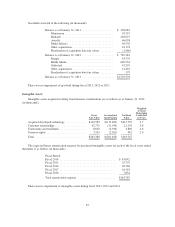

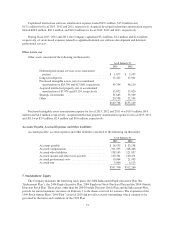

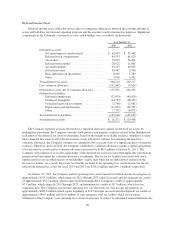

Prepaid expenses and other current assets consisted of the following (in thousands):

As of January 31,

2013 2012

Deferred professional services costs .................. $ 3,522 $10,399

Prepaid income taxes .............................. 21,180 12,785

Prepaid expenses and other current assets ............. 101,291 57,135

$125,993 $80,319

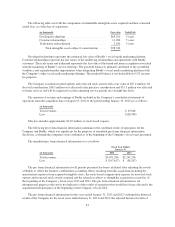

Capitalized Software, net

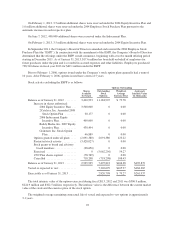

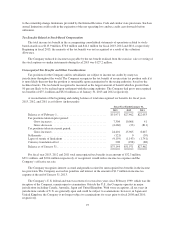

Capitalized software consisted of the following (in thousands):

As of January 31,

2013 2012

Capitalized internal-use software development costs, net

of accumulated amortization of $72,448 and $50,300,

respectively .................................. $ 59,647 $ 41,442

Acquired developed technology, net of accumulated

amortization of $179,906 and $99,886, respectively . . 147,676 146,970

$207,323 $188,412

90