Salesforce.com 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.services from other vendors, the nature of the professional services, the timing of when the professional services

contract was signed in comparison to the subscription service start date, and the contractual dependence of the

subscription service on the customer’s satisfaction with the professional services work. To date, we have

concluded that all of the professional services included in multiple-deliverable arrangements executed have

standalone value.

Under the updated accounting guidance, when multiple-deliverables included in an arrangement are

separated into different units of accounting, the arrangement consideration is allocated to the identified separate

units based on a relative selling price hierarchy. We determine the relative selling price for a deliverable based on

its vendor-specific objective evidence of selling price (“VSOE”), if available, or our best estimate of selling price

(“BESP”), if VSOE is not available. We have determined that third-party evidence (“TPE”) is not a practical

alternative due to differences in our service offerings compared to other parties and the availability of relevant

third-party pricing information. The amount of revenue allocated to delivered items is limited by contingent

revenue, if any.

For certain professional services, we have established VSOE as a consistent number of standalone sales of

this deliverable have been priced within a reasonably narrow range. We have not established VSOE for our

subscription services due to lack of pricing consistency, the introduction of new services and other factors.

Accordingly, we use our BESP to determine the relative selling price.

We determined BESP by considering our overall pricing objectives and market conditions. Significant

pricing practices taken into consideration include our discounting practices, the size and volume of our

transactions, the customer demographic, the geographic area where our services are sold, our price lists, our go-

to-market strategy, historical standalone sales and contract prices. The determination of BESP is made through

consultation with and approval by management, taking into consideration the go-to-market strategy. As our go-

to-market strategies evolve, we may modify our pricing practices in the future, which could result in changes in

relative selling prices, including both VSOE and BESP.

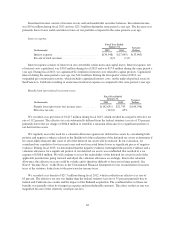

Deferred Revenue. The deferred revenue balance does not represent the total contract value of annual or

multi-year, non-cancelable subscription agreements. Deferred revenue primarily consists of billings or payments

received in advance of revenue recognition from subscription service described above and is recognized as the

revenue recognition criteria are met. We generally invoice customers in annual or quarterly installments.

Deferred revenue is influenced by several factors, including seasonality, the compounding effects of renewals,

invoice duration, invoice timing and new business linearity within the quarter.

As a result of the updated accounting guidance previously described, billings against professional services

arrangements entered into prior to February 1, 2011 were generally added to deferred revenue and recognized

over the remaining related subscription contract term.

Deferred revenue that will be recognized during the succeeding twelve month period is recorded as current

deferred revenue and the remaining portion is recorded as noncurrent.

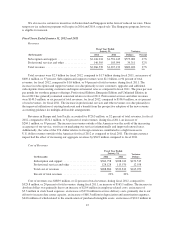

Deferred Commissions. We defer commission payments to our direct sales force. The commissions are

deferred and amortized to sales expense over the non-cancelable terms of the related subscription contracts with

our customers, which are typically 12 to 36 months. The commission payments, which are paid in full the month

after the customer’s service commences, are a direct and incremental cost of the revenue arrangements. The

deferred commission amounts are recoverable through the future revenue streams under the non-cancelable

customer contracts. We believe this is the preferable method of accounting as the commission charges are so

closely related to the revenue from the non-cancelable customer contracts that they should be recorded as an

asset and charged to expense over the same period that the subscription revenue is recognized.

37