Salesforce.com 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• uncertain tax positions and tax related valuation allowances assumed; and

• discount rates.

Unanticipated events and circumstances may occur that may affect the accuracy or validity of such

assumptions, estimates or actual results.

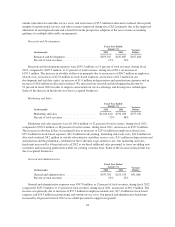

Stock-Based Options and Awards. We recognize the fair value of our stock options and awards on a straight-

line basis over the requisite service period of the option or award which is the vesting term of generally four

years for stock options and restricted stock awards and one year for shares issued pursuant to our Employee

Stock Purchase Plan (“ESPP”). The fair value of each option or award is estimated on the date of grant using the

Black-Scholes option pricing model. The estimated forfeiture rate applied is based on historical forfeiture rates.

Inputs into the Black-Scholes option pricing model include:

• The estimated life for the stock options which is estimated based on an actual analysis of expected life.

The estimated life for shares issued pursuant to our ESPP is based on the two purchase periods within

the 12 month offering period;

• The risk free interest rate which is based on the rate for a U.S. government security with the same

estimated life at the time of the option grant and the stock purchase rights; and

• The future stock price volatility which is estimated considering both our observed option-implied

volatilities and our historical volatility calculations. We believe this is the best estimate of the expected

volatility over the expected life of our stock options and stock purchase rights.

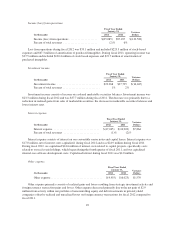

Income Taxes. We use the asset and liability method of accounting for income taxes. Under this method,

deferred tax assets and liabilities are determined based on temporary differences between the financial statement

and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are

expected to reverse. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the

consolidated statements of operations in the period that includes the enactment date.

Our tax positions are subject to income tax audits by multiple tax jurisdictions throughout the world. We

recognize the tax benefit of an uncertain tax position only if it is more likely than not that the position is

sustainable upon examination by the taxing authority, based on the technical merits. The tax benefit recognized is

measured as the largest amount of benefit which is greater than 50 percent likely to be realized upon settlement

with the taxing authority. We recognize interest accrued and penalties related to unrecognized tax benefits in our

income tax provision.

We regularly assess the need for a valuation allowance against our deferred tax assets. In making that

assessment, we consider both positive and negative evidence related to the likelihood of realization of the

deferred tax assets on a jurisdictional basis to determine, based on the weight of available evidence, whether it is

more likely than not that some or all of the deferred tax assets will not be realized. Examples of positive and

negative evidence include historical taxable income or losses, forecasted income or losses, the estimated timing

of the reversals of existing temporary differences as well as prudent and feasible tax planning strategies.

Valuation allowance is established when necessary to reduce deferred tax assets to the amounts more likely than

not expected to be realized. Our income tax provision would increase or decrease in the period in which the

assessment is changed.

Our tax provision could be adversely affected by changes in the mix of earnings and losses in countries with

differing statutory tax rates, certain non-deductible expenses, changes in the valuation of deferred tax assets and

liabilities, changes in tax laws and accounting principles as well as changes in excess tax benefits related to

exercises and vesting of stock-based compensation that are allocated directly to stockholders’ equity.

39