Salesforce.com 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.encourage the development of third-party applications on our platforms and continue to focus on retaining

customers at the time of renewal. Our plans to invest for future growth include the continuation of the expansion

of our data center capacity, the hiring of additional personnel, particularly in direct sales, other customer-related

areas and research and development, the expansion of domestic and international selling and marketing activities,

continuing to develop our brands, the addition of distribution channels, the upgrade of our service offerings, the

development of new services, the integration of acquired technologies, the expansion of our Marketing Cloud and

Salesforce Platform service offerings and the additions to our global infrastructure to support our growth.

We also regularly evaluate acquisitions or investment opportunities in complementary businesses, joint

ventures, services and technologies, and intellectual property rights in an effort to expand our service offerings.

We expect to continue to make such investments and acquisitions in the future and we plan to reinvest a

significant portion of our incremental revenue in fiscal 2014 to grow our business and continue our leadership

role in the cloud computing industry. As a result of our aggressive growth plans, specifically our hiring plan and

acquisition activities, we have incurred significant expenses from equity awards and amortization of purchased

intangibles which have resulted in net losses on a GAAP basis. As we continue with our growth plan, we

anticipate we will have net losses on a GAAP basis for the next several quarters.

In November 2010, we purchased approximately 14 acres of undeveloped real estate in San Francisco,

California, including entitlements and improvements associated with the land. We have capitalized all pre-

construction activities related to the development of the land, including interest costs and property taxes since the

November 2010 purchase. During the first quarter of fiscal 2013, we suspended pre-construction activity. The

total carrying value of the land, building improvements and perpetual parking rights was $321.1 million as of

January 31, 2013. We continue to evaluate our future needs for office facilities space and our options for the

undeveloped real estate.

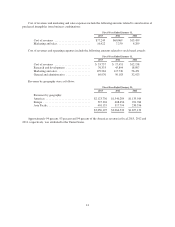

We expect marketing and sales costs, which were 53 percent of our total revenues for fiscal 2013 and

52 percent for fiscal 2012, to continue to represent a substantial portion of total revenues in the future as we seek

to add and manage more paying subscribers, and build greater brand awareness.

On August 13, 2012, we acquired the outstanding stock of Buddy Media, Inc., (“Buddy”), a social media

marketing platform. We acquired Buddy for the assembled workforce, expected synergies and expanded market

opportunities when integrating Buddy’s social media marketing platform with our current offerings. The

financial results of Buddy are included in our consolidated financial statements from the date of acquisition. The

total purchase price for Buddy was $735.8 million.

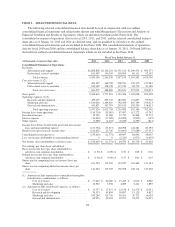

We regularly assess the need for a valuation allowance against our deferred tax assets. In making that

assessment, we consider both positive and negative evidence related to the likelihood of realization of the

deferred tax assets to determine, based on the weight of available evidence, whether it is more-likely-than-not

that some or all of the deferred tax assets will not be realized. In our evaluation, we considered our cumulative

loss in recent years and our forecasted future losses as significant pieces of negative evidence. During the third

quarter of fiscal 2013, we determined that the negative evidence outweighed the positive evidence as of

October 31, 2013 and recorded a one-time, non-cash charge to income tax expense in the third quarter of fiscal

2013 in the amount of $149.1 million to establish a valuation allowance for a significant portion of our deferred

tax assets. This accounting treatment has no effect on our actual ability to utilize deferred tax assets such as loss

carryforwards and tax credits to reduce future cash tax payments. We will continue to assess the realizability of

the deferred tax assets in each of the applicable jurisdictions going forward and adjust the valuation allowance

accordingly.

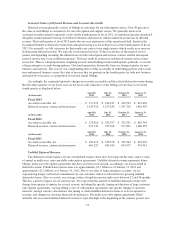

Fiscal Year

Our fiscal year ends on January 31. References to fiscal 2013, for example, refer to the fiscal year ending

January 31, 2013.

31