Salesforce.com 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

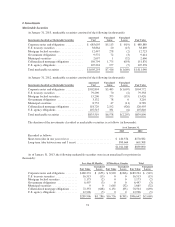

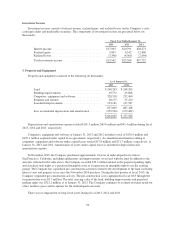

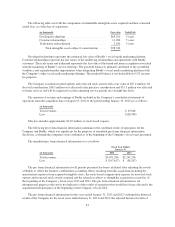

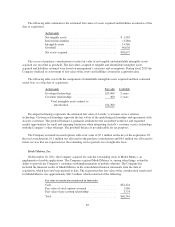

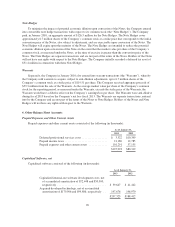

The following table sets forth the components of identifiable intangible assets acquired and their estimated

useful lives as of the date of acquisition:

(in thousands) Fair value Useful Life

Developed technology ............................ $ 84,200 3 years

Customer relationships ........................... 15,000 5 years

Trade name and trademark ........................ 3,800 3 years

Total intangible assets subject to amortization ..... $103,000

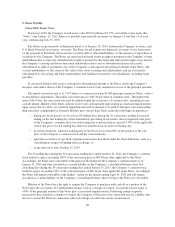

Developed technology represents the fair value of the Radian6 monitoring technology. Customer

relationships represent the fair values of the underlying relationships and agreements with Radian6 customers.

Trade name and trademark represents the fair value of brand and name recognition associated with the marketing

of Radian6 service offerings. The goodwill balance is primarily attributed to the assembled workforce, expanded

market opportunities and expected synergies when integrating Radian6’s social solution media technology with

the Company’s offerings. The goodwill balance is deductible for tax purposes.

The Company assumed unvested options with a fair value of $23.9 million on the day of the acquisition. Of

the total consideration, $4.7 million was allocated to the purchase consideration and $19.2 million was allocated

to future services that are expensed over the remaining service periods on a straight-line basis.

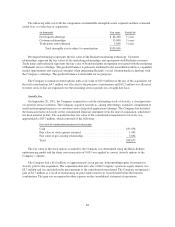

Assistly, Inc.

On September 20, 2011, the Company acquired for cash the outstanding stock of Assistly, a cloud provider

of customer service solutions. The Company acquired Assistly to, among other things, extend its commitment to

small and emerging businesses in customer service help desk application offerings. The Company has included

the financial results of Assistly in the consolidated financial statements from the date of acquisition, which have

not been material to date. The acquisition date fair value of the consideration transferred for Assistly was

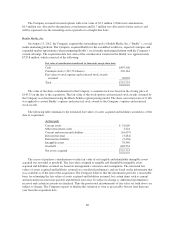

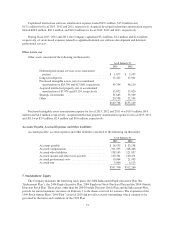

approximately $58.7 million, which consisted of the following:

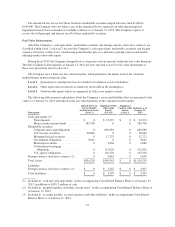

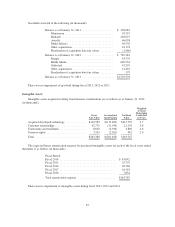

Fair value of consideration transferred (in thousands)

Cash ..................................................... $53,938

Fair value of stock options assumed ............................ 1,043

Fair value of pre-existing relationship ........................... 3,694

Total ..................................................... $58,675

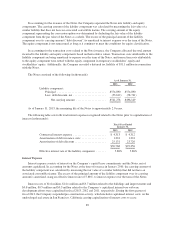

The fair value of the stock options assumed by the Company was determined using the Black-Scholes

option pricing model and the share conversion ratio of 0.031 was applied to convert Assistly options to the

Company’s options.

The Company had a $1.0 million, or approximately seven percent, noncontrolling equity investment in

Assistly prior to the acquisition. The acquisition date fair value of the Company’s previous equity interest was

$3.7 million and was included in the measurement of the consideration transferred. The Company recognized a

gain of $2.7 million as a result of remeasuring its prior equity interest in Assistly held before the business

combination. The gain was recognized in other expense on the consolidated statement of operations.

84