Salesforce.com 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

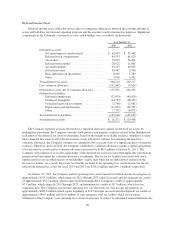

The Company believes that it has provided adequate reserves for its income tax uncertainties in all open tax

years. In the next 12 months, it is reasonably possible that the unrecognized tax benefits may decrease by

approximately $4.0 million due to lapsing of the statute of limitations.

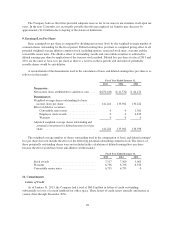

9. Earnings/Loss Per Share

Basic earnings/loss per share is computed by dividing net income (loss) by the weighted-average number of

common shares outstanding for the fiscal period. Diluted earnings/loss per share is computed giving effect to all

potential weighted average dilutive common stock, including options, restricted stock units, warrants and the

convertible senior notes. The dilutive effect of outstanding awards and convertible securities is reflected in

diluted earnings per share by application of the treasury stock method. Diluted loss per share for fiscal 2013 and

2012 are the same as basic loss per share as there is a net loss in these periods and inclusion of potentially

issuable shares would be anti-dilutive.

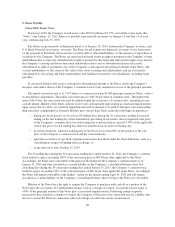

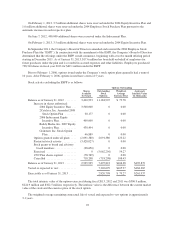

A reconciliation of the denominator used in the calculation of basic and diluted earnings/loss per share is as

follows (in thousands):

Fiscal Year Ended January 31,

2013 2012 2011

Numerator:

Net income (loss) attributable to salesforce.com .... $(270,445) $ (11,572) $ 64,474

Denominator:

Weighted-average shares outstanding for basic

income (loss) per share ...................... 141,224 135,302 130,222

Effect of dilutive securities:

Convertible senior notes ................... 0 0 1,561

Employee stock awards .................... 0 0 4,815

Warrants ............................... 0 0 0

Adjusted weighted-average shares outstanding and

assumed conversions for diluted income (loss) per

share .................................... 141,224 135,302 136,598

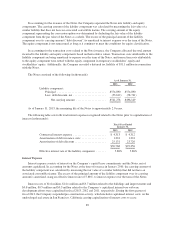

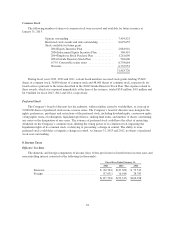

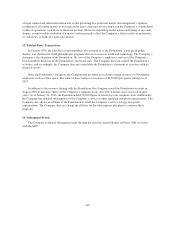

The weighted-average number of shares outstanding used in the computation of basic and diluted earnings/

loss per share does not include the effect of the following potential outstanding common stock. The effects of

these potentially outstanding shares were not included in the calculation of diluted earnings/loss per share

because the effect would have been anti-dilutive (in thousands):

Fiscal Year Ended January 31,

2013 2012 2011

Stock awards ................................ 7,517 7,560 1,061

Warrants ................................... 6,736 6,736 6,376

Convertible senior notes ....................... 6,735 6,735 0

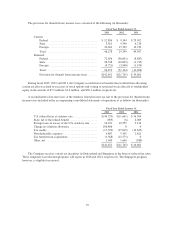

10. Commitments

Letters of Credit

As of January 31, 2013, the Company had a total of $60.8 million in letters of credit outstanding

substantially in favor of certain landlords for office space. These letters of credit renew annually and mature at

various dates through December 2030.

98