Salesforce.com 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

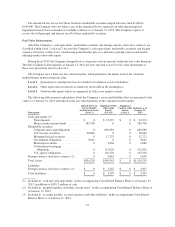

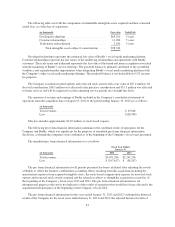

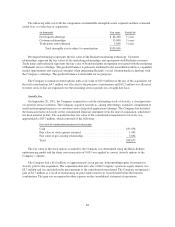

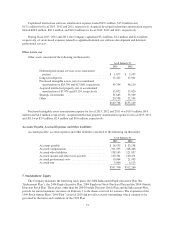

Other Fiscal 2013 Business Combinations

During fiscal 2013, the Company acquired five additional companies for $15.1 million in cash, net of cash

acquired, and has included the financial results of these companies in its consolidated financial statements from

the date of each respective acquisition. The Company accounted for these transactions as business combinations.

In allocating the purchase consideration based on estimated fair values, the Company recorded $4.1 million of

acquired intangible assets with useful lives of one to three years, $12.4 million of goodwill, $0.3 million of net

tangible liabilities and $1.0 million of deferred tax liabilities. Some of this goodwill balance is deductible for

U.S. income tax purposes. With the exception of Buddy, none of the aforementioned business combinations,

individually and in the aggregate, were material to the pro forma combined historical results of operations of the

Company.

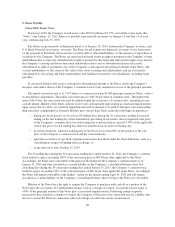

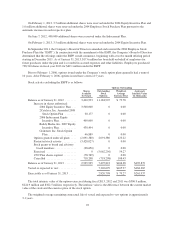

Fiscal Year 2012

Radian6 Technologies Inc.

In May 2011, the Company acquired for cash and the Company’s common stock the outstanding stock of

Radian6 Technologies, Inc. (“Radian6”), a cloud application vendor based in Canada that provides customers

with social media monitoring, measurement and engagement solutions. The Company acquired Radian6 to,

among other things, expand its social enterprise market opportunities. The Company has included the financial

results of Radian6 in the consolidated financial statements from the date of acquisition, which have not been

material to date. The acquisition date fair value of the consideration transferred for Radian6 was approximately

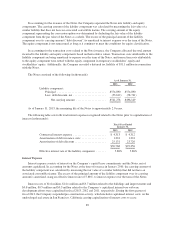

$336.6 million, which consisted of the following:

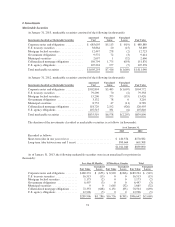

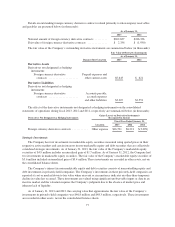

Fair value of consideration transferred (in thousands, except number

of share data):

Cash ............................................ $282,600

Common stock (436,167 shares) ...................... 49,319

Fair value of stock options assumed ................... 4,729

Total ............................................ $336,648

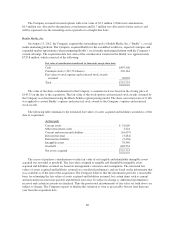

The value of the share consideration for the Company’s common stock was based on the closing price of

$136.19 on the day of the acquisition. The fair value of the stock options assumed by the Company was

determined using the Black-Scholes option pricing model and the share conversion ratio of 0.196 was applied to

convert Radian6 options to the Company’s options.

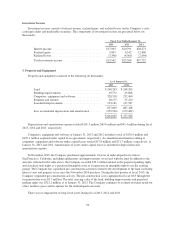

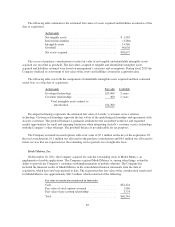

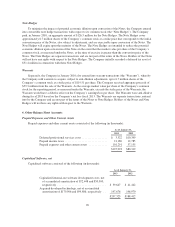

The following table summarizes the estimated fair values of assets acquired and liabilities assumed as of the

date of acquisition:

(in thousands)

Tangible assets .................................... $ 12,364

Current and noncurrent liabilities ...................... (12,757)

Deferred revenue .................................. (680)

Deferred tax liability ............................... (27,306)

Intangible assets ................................... 103,000

Goodwill ......................................... 262,027

Net assets acquired ................................. $336,648

The excess of purchase consideration over the fair value of net tangible and identifiable intangible assets

acquired was recorded as goodwill. The fair values assigned to tangible and identifiable intangible assets

acquired and liabilities assumed were based on management’s estimates and assumptions. During fiscal 2013 the

Company finalized its assessment of fair value of the assets and liabilities assumed at acquisition date.

83