Salesforce.com 2013 Annual Report Download - page 72

Download and view the complete annual report

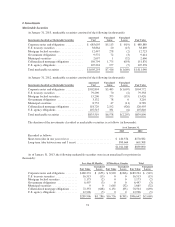

Please find page 72 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Amounts that have been invoiced are recorded in accounts receivable and in deferred revenue or revenue,

depending on whether the revenue recognition criteria have been met.

Professional Services and Other Revenues

The majority of the Company’s professional services contracts are on a time and material basis. When these

services are not combined with subscription revenues as a single unit of accounting, as discussed below, these

revenues are recognized as the services are rendered for time and material contracts, and when the milestones are

achieved and accepted by the customer for fixed price contracts. Training revenues are recognized as the services

are performed.

Multiple-Deliverable Arrangements

The Company enters into arrangements with multiple-deliverables that generally include subscription,

premium support and professional services.

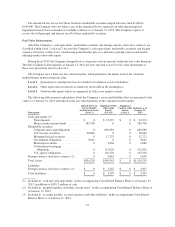

Prior to February 1, 2011, the deliverables in multiple-deliverable arrangements were accounted for

separately if the delivered items had standalone value and there was objective and reliable evidence of fair value

for the undelivered items. If the deliverables in a multiple-deliverable arrangement could not be accounted for

separately, the total arrangement fee was recognized ratably as a single unit of accounting over the contracted

term of the subscription agreement. A significant portion of the Company’s multiple-deliverable arrangements

were accounted for as a single unit of accounting because the Company did not have objective and reliable

evidence of fair value for certain of its deliverables. Additionally, in these situations, the Company deferred the

direct costs of a related professional services arrangement and amortized those costs over the same period as the

professional services revenue was recognized.

In October 2009, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

No. 2009-13, “ Revenue Recognition (Topic 605), Multiple-Deliverable Revenue Arrangements—a consensus of

the FASB Emerging Issues Task Force “ (“ASU 2009-13”) which amended the previous multiple-deliverable

arrangements accounting guidance. Pursuant to the updated guidance, objective and reliable evidence of fair

value of the deliverables to be delivered is no longer required in order to account for deliverables in a multiple-

deliverable arrangement separately. Instead, arrangement consideration is allocated to deliverables based on their

relative selling price.

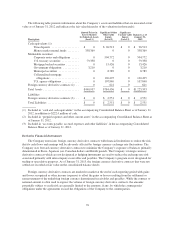

In the first quarter of fiscal 2012, the Company adopted this updated accounting guidance on a prospective

basis. The Company applied the updated accounting guidance to those multiple-deliverable arrangements entered

into or materially modified on or after February 1, 2011, which was the beginning of the Company’s fiscal 2012.

The adoption of this updated accounting guidance did not have a material impact on the Company’s

financial condition, results of operations or cash flows for the fiscal year ended January 31, 2012. As of

January 31, 2013, the deferred professional services revenue and deferred costs under the previous accounting

guidance are $9.3 million and approximately $3.9 million, respectively, which will continue to be recognized

over the related remaining subscription period.

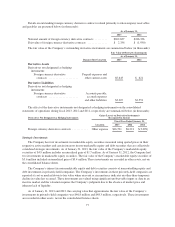

Under the updated accounting guidance, in order to treat deliverables in a multiple-deliverable arrangement

as separate units of accounting, the deliverables must have standalone value upon delivery. If the deliverables

have standalone value upon delivery, the Company accounts for each deliverable separately. Subscription

services have standalone value as such services are often sold separately. In determining whether professional

services have standalone value, the Company considers the following factors for each professional services

agreement: availability of the services from other vendors, the nature of the professional services, the timing of

when the professional services contract was signed in comparison to the subscription service start date and the

contractual dependence of the subscription service on the customer’s satisfaction with the professional services

work. To date, the Company has concluded that all of the professional services included in multiple-deliverable

arrangements executed have standalone value.

68