Salesforce.com 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

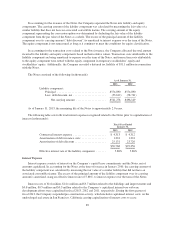

In accounting for the issuance of the Notes, the Company separated the Notes into liability and equity

components. The carrying amount of the liability component was calculated by measuring the fair value of a

similar liability that does not have an associated convertible feature. The carrying amount of the equity

component representing the conversion option was determined by deducting the fair value of the liability

component from the par value of the Notes as a whole. The excess of the principal amount of the liability

component over its carrying amount (“debt discount”) is amortized to interest expense over the term of the Notes.

The equity component is not remeasured as long as it continues to meet the conditions for equity classification.

In accounting for the transaction costs related to the Note issuance, the Company allocated the total amount

incurred to the liability and equity components based on their relative values. Transaction costs attributable to the

liability component are being amortized to expense over the term of the Notes, and transaction costs attributable

to the equity component were netted with the equity component in temporary stockholders’ equity and

stockholders’ equity. Additionally, the Company recorded a deferred tax liability of $51.1 million in connection

with the Notes.

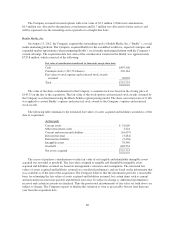

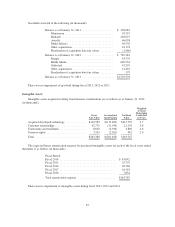

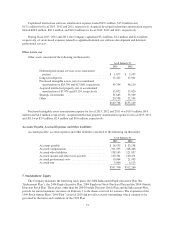

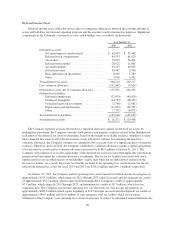

The Notes consisted of the following (in thousands):

As of January 31,

2013 2012

Liability component :

Principal .................................. $574,890 $574,890

Less: debt discount, net ....................... (53,612) (78,741)

Net carrying amount ..................... $521,278 $496,149

As of January 31, 2013, the remaining life of the Notes is approximately 2.0 years.

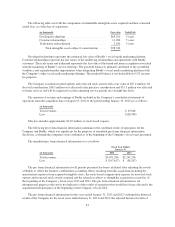

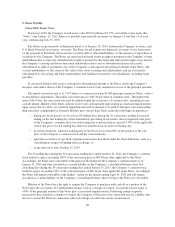

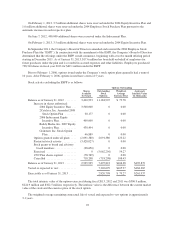

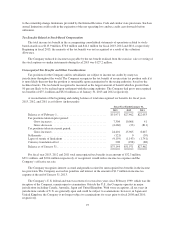

The following table sets forth total interest expense recognized related to the Notes prior to capitalization of

interest (in thousands):

Fiscal Year Ended

January 31,

2013 2012

Contractual interest expense ....................... $ 4,313 $ 4,312

Amortization of debt issuance costs ................. 1,324 1,324

Amortization of debt discount ...................... 25,131 23,720

$30,768 $29,356

Effective interest rate of the liability component ....... 5.86% 5.86%

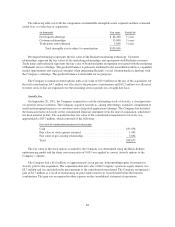

Interest Expense

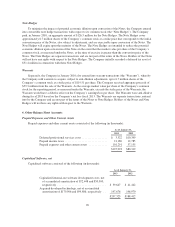

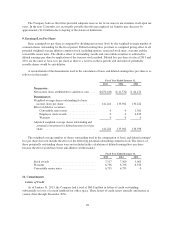

Interest expense consists of interest on the Company’s capital lease commitments and the Notes, net of

amounts capitalized. In accounting for the Notes at the time of issuance in January 2010, the carrying amount of

the liability component was calculated by measuring the fair value of a similar liability that did not have an

associated convertible feature. The excess of the principal amount of the liability component over its carrying

amount is amortized, using an effective interest rate of 5.86%, to interest expense over the term of the Notes.

Interest costs of $1.6 million, $14.1 million and $3.7 million related to the buildings and improvements and

$0.8 million, $0.5 million and $0.3 million related to the Company’s capitalized internal-use software

development efforts were capitalized in fiscal 2013, 2012 and 2011, respectively. During the first quarter of

fiscal 2013, the Company suspended pre-construction activity, which includes capitalized interest costs, on the

undeveloped real estate in San Francisco, California causing capitalization of interest costs to cease.

89