Public Storage 2001 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

C

ONSOLIDATED

S

TATEMENTS OF

I

NCOME

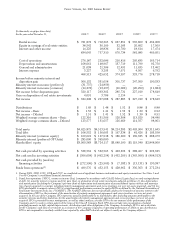

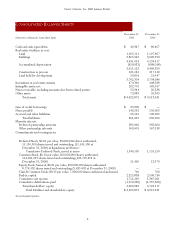

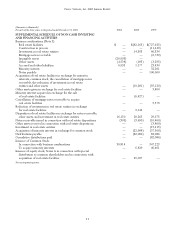

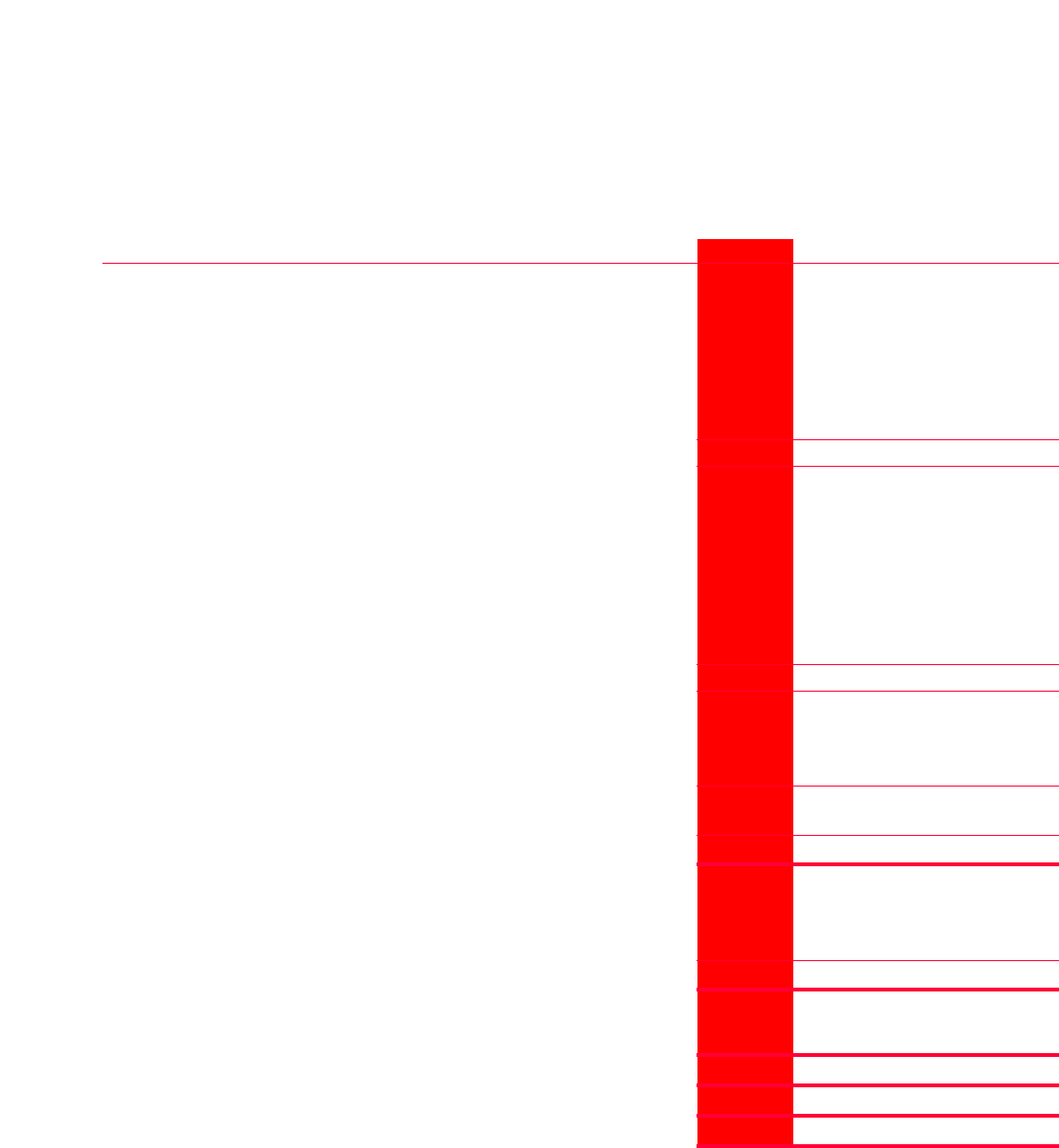

(Amounts in thousands, except share data)

For each of the three years in the period ended December 31, 2001

2001 2000 1999

Revenues:

Rental income:

Self-storage facilities $721,662 $653,110 $592,619

Commercial properties 12,530 11,341 8,204

Containerized storage facilities 47,686 37,914 27,028

Equity in earnings of real estate entities 38,542 36,109 32,183

Interest and other income 14,225 18,836 16,700

834,645 757,310 676,734

Expenses:

Cost of operations:

Storage facilities 229,211 210,462 184,481

Commercial properties 3,972 3,826 2,826

Containerized storage facilities 43,004 37,798 29,509

Depreciation and amortization 168,061 148,967 137,719

General and administrative 21,038 21,306 12,491

Interest expense 3,227 3,293 7,971

468,513 425,652 374,997

Income before minority interest and disposition gain 366,132 331,658 301,737

Minority interest in income:

Preferred partnership interests (31,737) (24,859) —

Other partnership interests (14,278) (13,497) (16,006)

Net income before disposition gain 320,117 293,302 285,731

Gain on disposition of real estate and real estate investments 4,091 3,786 2,154

Net income $324,208 $297,088 $287,885

Net income allocation:

Allocable to preferred shareholders $117,979 $100,138 $94,793

Allocable to Equity Stock, Series A 19,455 11,042 —

Allocable to common shareholders 186,774 185,908 193,092

$324,208 $297,088 $287,885

Per common share:

Basic net income per share $ 1.53 $ 1.41 $ 1.53

Diluted net income per share $ 1.51 $ 1.41 $ 1.52

Basic weighted average common shares outstanding 122,310 131,566 126,308

Diluted weighted average common shares outstanding 123,577 131,657 126,669

See accompanying notes.