Public Storage 2001 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

partnership; these limited partnership units are convertible at our option, subject to certain conditions, on a one-for-one basis

into PSB common stock. Based upon PSB’s trading price at December 31, 2001 ($31.50), the shares and units had a market value

of approximately $400.8 million.

At December 31, 2001, PSB owned and operated 14.8 million net rentable square feet of commercial space located in nine

states. PSB also manages the commercial space owned by the Company and the Consolidated Entities.

During 2001 and 2000, respectively, we received a total of $14,443,000 and $12,391,000 in distributions from PSB.

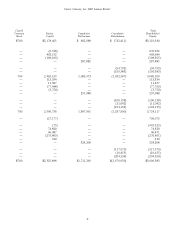

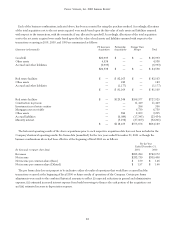

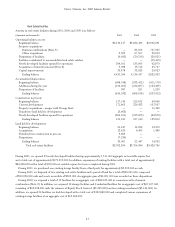

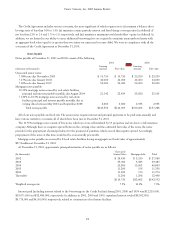

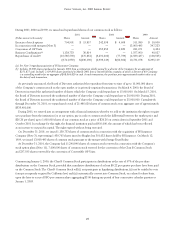

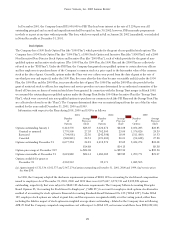

The following table sets forth the condensed statements of operations for each of the two years ended December 31, 2001, and

the condensed balance sheets of PSB at December 31, 2001 and 2000. These amounts below represent 100% of PSB’s balances

and not our pro-rata share.

PSB

(Amounts in thousands)

2001 2000

For the year ended December 31,

Total revenue $ 170,391 $150,634

Gain on real estate investments 8 8,105

Cost of operations and other expenses (51,973) (45,180)

Depreciation and amortization (41,067) (35,637)

Minority interest (27,489) (26,741)

Net income $49,870 $ 51,181

At December 31,

Total assets (primarily real estate) $1,169,955 $930,756

Total debt 165,145 30,971

Other liabilities 45,188 28,964

Preferred equity and preferred minority interests 318,750 199,750

Common equity 640,872 671,071

Investment in Development Joint Venture

In April 1997, the Company and an institutional investor formed a joint venture partnership (the “Development Joint Venture”)

for the purpose of developing approximately $220 million of self-storage facilities. The Development Joint Venture has a total of

47 opened facilities with a total cost of $232 million and was fully committed at December 31, 2000. The partnership is funded

solely with equity capital consisting of 30% from the Company and 70% from the institutional investor.

The term of the joint venture is 7 years, after which the properties would either be sold to third parties or acquired by either

of the partners (at their option) based upon the then fair market value of the facilities. Under the partnership agreement, the sales

proceeds would generally be allocated to the partners pro rata based upon ownership interests, however, at various returns on

investment milestones to the investor our share in the sales proceeds would be promoted to a higher percentage interest.

In addition, five years after inception of the partnership, the Company has the right (but not the obligation) to purchase the

institutional investor’s interest in the partnership. Under the partnership agreement, the purchase price for the interest would be

equal to an amount, when combined with all the prior cash flows of the institutional investor, would result in an internal rate of

return of 11.5% to the investor from the inception of the partnership through the acquisition date.

During 2001 and 2000, respectively, we invested a total of $14,997,000 and $3,262,000 in the Development Joint Venture.

During 2001 and 2000, respectively, we received distributions totaling $5,592,000 and $1,120,000 from the Development

Joint Venture.