Public Storage 2001 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

For these purposes, FFO means net income (loss) (computed in accordance with generally accepted accounting principles)

before (i) gain (loss) on early extinguishment of debt, (ii) minority interest in income and (iii) gain (loss) on disposition of real

estate, adjusted as follows: (i) plus depreciation and amortization (including the Company’s pro-rata share of depreciation and

amortization of unconsolidated equity interests and amortization of assets acquired in a merger, including property management

agreements and goodwill), and (ii) less FFO attributable to minority interest. For these purposes, FFO per Common Share means

FFO less preferred stock dividends (other than dividends on convertible preferred stock) divided by the outstanding weighted

average shares of Common Stock assuming conversion of all outstanding convertible securities and the Class B Common Stock.

For these purposes, FFO per share of Common Stock (as defined) was $2.93 for the year ended December 31, 2001.

Equity Stock

The Company is authorized to issue up to 200,000,000 shares of Equity Stock. The Articles of Incorporation provide that the

Equity Stock may be issued from time to time in one or more series and gives the Board of Directors broad authority to fix the

dividend and distribution rights, conversion and voting rights, redemption provisions and liquidation rights of each series of

Equity Stock.

Equity Stock, Series A

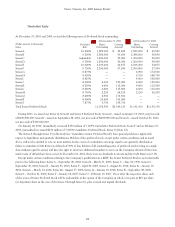

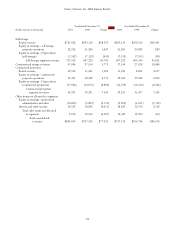

As of December 31, 2001, there were 8,776,102 depositary shares, each representing 1/1,000 of a share, of Equity Stock, Series A

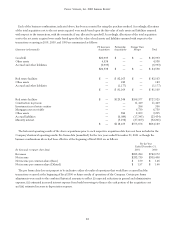

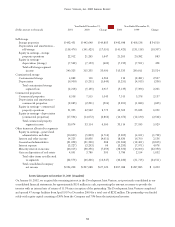

outstanding. The following table summarizes the activity:

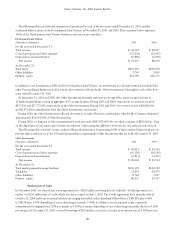

2001 2000

Depositary Issuance Depositary Issuance

(Dollar amounts in thousands)

Shares Amount Shares Amount

Amount at beginning of year 5,635,602 $113,354 — $ —

Public offerings 2,210,500 51,836 3,382,500 68,318

Direct placements 930,000 22,984 — —

Special dividend — — 2,200,555 44,011

Issued to a related party in connection with

acquisitions of real estate facilities — — 52,547 1,025

Amount at end of year 8,776,102 $188,174 5,635,602 $113,354

The issuance amounts have been recorded as part of paid-in capital on the consolidated balance sheet.

The Equity Stock, Series A ranks on a parity with common stock and junior to the Senior Preferred Stock with respect to

general preference rights and has a liquidation amount which cannot exceed $24.50 per share. Distributions with respect to each

depositary share shall be the lesser of: a) five times the per share dividend on the Common Stock or b) $2.45 per annum (prorated

for the year 2000). Except in order to preserve the Company’s federal income tax status as a REIT, we may not redeem the

depositary shares before March 31, 2010. On or after March 31, 2010, we may, at our option, redeem the depositary shares at

$24.50 per depositary share. If the Company fails to preserve its federal income tax status as a REIT, each depositary share will be

convertible into 0.956 shares of common stock. The depositary shares are otherwise not convertible into common stock. Holders

of depositary shares vote as a single class with our holders of common stock on shareholder matters, but the depositary shares have

the equivalent of one-tenth of a vote per depositary share. We have no obligation to pay distributions if no distributions are paid to

common shareholders.