Public Storage 2001 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

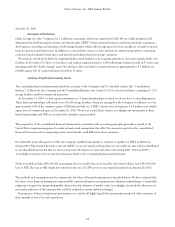

Revenue and Expense Recognition

Property rents are recognized as earned. Equity in earnings of real estate entities are recognized based on our ownership interest in

the earnings of each of the unconsolidated real estate entities. Advertising costs of $21,987,000, $11,987,000 and $10,160,000 for

2001, 2000 and 1999, respectively, were expensed as incurred. Repairs and maintenance expenditures are expensed as incurred.

Environmental Costs

Our policy is to accrue environmental assessments and/or remediation cost when it is probable that such efforts will be required and

the related costs can be reasonably estimated. Our current practice is to conduct environmental investigations in connection with

property acquisitions. Although there can be no assurance, we are not aware of any environmental contamination of any of our

facilities which individually or in the aggregate would be material to our overall business, financial condition, or results of operations.

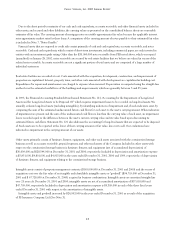

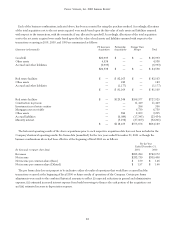

Net Income Per Common Share

Preferred stock dividends totaling $117,979,000, $100,138,000 and $94,793,000 for the years ended December 31, 2001, 2000

and 1999, respectively, have been deducted from net income to arrive at net income allocable to our common shareholders.

Net income allocated to our common shareholders has been further allocated among our two classes of common stock; our

regular common stock and our Equity Stock, Series A. The allocation among each class was based upon the two-class method.

Under the two-class method, earnings per share for each class of common stock is determined according to dividends declared

(or accumulated) and participation rights in undistributed earnings. Under the two-class method, the Equity Stock, Series A for

the years ended December 31, 2001 and 2000 were allocated approximately $19,455,000 and $11,042,000 of net income. The

remaining $186,774,000, $185,908,000, and $193,092,000, for the years ended December 31, 2001, 2000, and 1999,

respectively, was allocated to the regular common shares.

Basic net income per share is computed using the weighted average common shares outstanding (prior to the dilutive impact

of stock options outstanding). Diluted net income per common share is computed using the weighted average common shares

outstanding (adjusted for the dilutive impact of stock options outstanding that totaled 1,267,000 in 2001, 91,000 in 2000 and

361,000 shares in 1999).

Commencing January 1, 2000, the Company’s 7,000,000 Class B common shares outstanding began to participate in

distributions of the Company’s earnings. Distributions per share of Class B common stock are equal to 97% of the per share

distribution paid to the Company’s regular common shares. As a result of this participation in distribution of earnings, for purposes

of computing net income per common share, we began to include 6,790,000 (7,000,000 x 97%) Class B common shares in the

weighted average common equivalent shares for the years ended December 31, 2001 and 2000. Weighted average shares for the

year ended December 31, 1999 does not include any shares with respect to the Class B common stock as these shares did not

participate in distributions of the Company’s earnings prior to January 1, 2000.

Stock-Based Compensation

In October 1995, the Financial Accounting Standards Board issued Statement No. 123 “Accounting for Stock-Based

Compensation” which provides companies an alternative to accounting for stock-based compensation as prescribed under APB

Opinion No. 25 (APB 25). Statement 123 encourages, but does not require companies to recognize expense for stock-based

awards based on their fair value at date of grant. Statement No. 123 allows companies to continue to follow existing accounting

rules (fair value method under APB 25) provided that pro-forma disclosures are made of what net income and earnings per share

would have been had the new fair value method been used. We have elected to adopt the disclosure requirements of Statement

No. 123 but will continue to account for stock-based compensation under APB 25.

Reclassifications

Certain reclassifications have been made to the consolidated financial statements for 1999 and 2000 in order to conform to the

2001 presentation.