Public Storage 2001 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

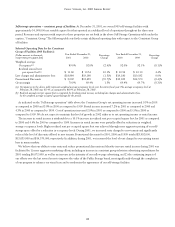

The following discussion and analysis should be read in conjunction with the Company’s consolidated financial statements and

notes thereto.

Forward Looking Statements:

When used within this document, the words “expects,” “believes,” “anticipates,” “should,” “estimates,” and similar expressions are

intended to identify “forward-looking statements” within the meaning of that term in Section 27A of the Securities Exchange Act

of 1933, as amended, and in Section 21F of the Securities Exchange Act of 1934, as amended. Such forward-looking statements

involve known and unknown risks, uncertainties, and other factors, which may cause the actual results and performance of the

Company to be materially different from those expressed or implied in the forward looking statements. Such factors described in

“Risk Factors” include the impact of competition from new and existing storage and commercial facilities which could impact

rents and occupancy levels at the Company’s facilities; the Company’s ability to evaluate, finance, and integrate acquired and

developed properties into the Company’s existing operations; the Company’s ability to effectively compete in the markets

in which it does business; the impact of the regulatory environment as well as national, state, and local laws and regulations

including, without limitation, those governing real estate investment trusts; the acceptance by consumers of the containerized

storage concept; the impact of general economic conditions upon rental rates and occupancy levels at the Company’s facilities;

and the availability of permanent capital at attractive rates.

Critical Accounting Policy – Impairment of Long Lived Assets:

Substantially all of the Company’s assets consist of long-lived assets, including real estate, the assets associated with the

containerized storage business, goodwill, and other intangible assets. We annually evaluate our long-lived assets for impairment.

This evaluation includes identifying indicators of impairment. When indicators of impairment are present and the undiscounted

future cash flows of the assets are less than the carrying amount, an impairment charge is recorded. The Company has determined

at December 31, 2001 that no such impairments existed and, accordingly, no impairment charges have been recorded.

The Financial Accounting Standards Board (“FASB”) has recently issued Statement of Financial Accounting Standards No. 142,

“Goodwill and Other Intangible Assets” (“SFAS 142”), and Statement of Financial Accounting Standards No. 144, “Accounting for

the Impairment and Disposal of Long-Lived Assets” (“SFAS 144”). Each of these Statements addresses the procedures to be

followed in evaluating and recording impairment losses with respect to long-lived assets. The Company will adopt each of these

Statements in the beginning of its fiscal year ended December 31, 2002, and expects that there will be no material impact from

these statements with respect to impairment losses.

However, future events could cause us to conclude that our long-lived assets are impaired. Any resulting impairment loss could

have a material adverse impact on our financial condition and results of operations.

Overview:

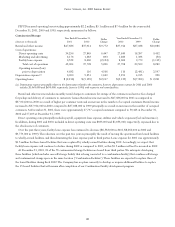

The self-storage industry is highly fragmented and is composed predominantly of numerous local and regional operators.

Competition in the markets in which we operate is significant and is increasing from additional development of storage facilities

in many markets which may negatively impact occupancy levels and rental rates at the storage facilities. However, we believe

that we possess several distinguishing characteristics which enable us to compete effectively with other owners and operators.

We are the largest owner and operator of self-storage facilities in the United States with ownership interests as of December 31,

2001 in 1,384 storage facilities containing approximately 83.7 million net rentable square feet. All of our facilities are operated

under the “Public Storage” brand name, which we believe is the most recognized and established name in the storage industry.

Located in the major metropolitan markets of 37 states, our storage facilities are geographically diverse, giving us national recognition

and prominence. This concentration establishes us as one of the dominant providers of storage space in most markets in which we

M

ANAGEMENT

’

S

D

ISCUSSION AND

A

NALYSIS OF

F

INANCIAL

C

ONDITION

AND

R

ESULTS OF

O

PERATIONS