Public Storage 2001 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

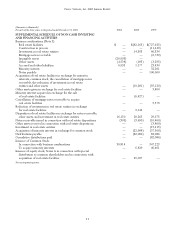

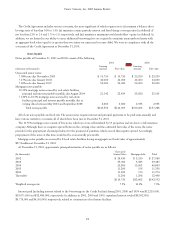

During 2000, we disposed of eight storage facilities and two parcels of land for an aggregate of $20,561,000, consisting of cash

($10,444,000), the acquisition of minority interest ($6,427,000), and a note receivable ($3,690,000). An aggregate gain of

$296,000 was recorded on these dispositions.

During 1999, we acquired a total of 253 real estate facilities for an aggregate cost of $727,925,000 in connection with certain

business combinations (Note 3). In addition, we also acquired three storage facilities and two industrial facilities for an aggregate

cost of $36,013,000, consisting of the cancellation of mortgage notes receivable ($5,573,000), other assets ($3,800,000), and cash

($26,640,000).

In April 1999, we sold six properties for approximately $10,500,000 (composed of $1,460,000 cash, notes receivable of

$5,240,000, and other assets of $3,800,000). In addition, during 1999, we disposed of an industrial facility, two storage facilities

through condemnation proceedings, and four parcels of land for an aggregate of approximately $16,416,000, composed of

$11,196,000 cash and $5,220,000 mortgage notes receivable. In aggregate, we recorded a gain upon sale of $2,154,000,

representing the difference between the proceeds received and the net book value of the real estate.

At December 31, 2001, the unaudited adjusted basis of real estate facilities for Federal income tax purposes was approximately

$3.0 billion.

Construction in Process and Land Held for Development

Construction in process consists of land and development costs relating to the development of storage facilities. At December 31,

2001, construction in process consists primarily of 25 facilities being developed on newly acquired land and the expansion of

seven existing facilities.

In addition, we have 12 parcels of land held for development with total costs of approximately $30,001,000.

Note 5 — Investments in Real Estate Entities

At December 31, 2001, our investments in real estate entities consist of ownership interests in 11 partnerships, which principally

own self-storage facilities, and an ownership interest in PSB. These interests are non-controlling interests of less than 50% and are

accounted for using the equity method of accounting. Accordingly, earnings are recognized based upon our ownership interest in

each of the partnerships. The accounting policies of these entities are similar to the Company’s.

During 2001, 2000 and 1999, we recognized earnings from our investments of $38,542,000, $36,109,000 and $32,183,000,

respectively, and received cash distributions totaling $24,124,000, $16,984,000 and $15,949,000, respectively. In addition, during

2000, we recognized a gain of $3,210,000, representing our share of PSB’s gains on sale of real estate and real estate investments;

this gain is presented as “Gain on the disposition of real estate and real estate investments” in our consolidated income statement.

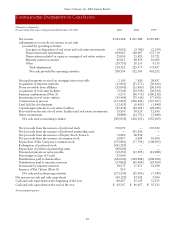

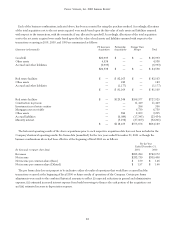

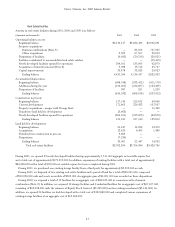

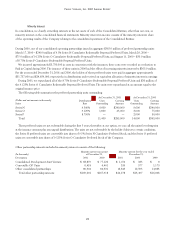

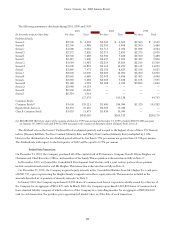

The following table sets forth our investments in the Unconsolidated Entities at December 31, 2001 and 2000 and our Equity

in Earnings of Real Estate Investments for each of the three years ended December 31, 2001:

Investments in Equity in Earnings of

Real Estate Entities at Real Estate Entities for the year ended

December 31, December 31,

2001 2000 2001 2000 1999

PSB $267,472 $259,554 $22,361 $20,740 $18,988

Development Joint Venture 79,263 65,631 4,227 2,694 1,179

Other Investments 132,565 123,743 11,954 12,675 12,016

Total $479,300 $448,928 $38,542 $36,109 $32,183

Investment in PSB

On January 2, 1997, we reorganized our commercial property operations into an entity now known as PS Business Parks, Inc., a

REIT traded on the American Stock Exchange, and an operating partnership controlled by PS Business Parks, Inc. (collectively, the

REIT and the operating partnership are referred to as “PSB”). The Company and certain partnerships in which the Company has

a controlling interest have a 44% common equity interest in PSB as of December 31, 2001. This 44% common equity interest is

comprised of the ownership of 5,418,273 shares of common stock and 7,305,355 limited partnership units in the operating