Public Storage 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

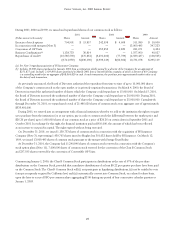

$295,417,000 and $286,551,000 in 2001, 2000 and 1999, respectively. Diluted net income per share would have been $1.48,

$1.40 and $1.51 in 2001, 2000 and 1999, respectively. Basic net income per share would have been $1.49, $1.40, and $1.52,

respectively. In computing such compensation cost, the Company used the Black-Scholes method with a risk-free interest rate of

5.55% for 1999, 6.16% for 2000 and 4.08% for 2001; an expected life of 5 years for each year; expected volatility of .201 for

1999, .191 for 2000 and .155 for 2001; and an expected dividend yield of 7% for each year.

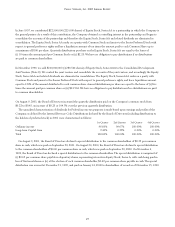

Note 12 — Disclosures Regarding Segment Reporting

In July 1997, the Financial Accounting Standards Board issued Statement No. 131, “Disclosures about Segments of an Enterprise

and Related Information” (“FAS 131”), which establishes standards for the way that public business enterprises report information

about operating segments. This statement is effective for financial statements for periods beginning after December 15, 1997. We

adopted this standard effective for the year ended December 31, 1998.

Description of Each Reportable Segment

Our reportable segments reflect significant operating activities that are evaluated separately by management. We have three

reportable segments: self-storage operations, containerized storage operations, and commercial property operations.

The self-storage segment comprises the direct ownership, development, and operation of traditional storage facilities, and the

ownership of equity interests in entities that own storage properties. PSPUD operates the containerized storage segment. The

commercial property segment reflects our interest in the ownership, operation, and management of commercial properties. The

vast majority of the commercial property operations are conducted through PSB, and to a much lesser extent the Company and

certain of its unconsolidated subsidiaries own commercial space, managed by PSB, within facilities that combine storage and

commercial space for rent.

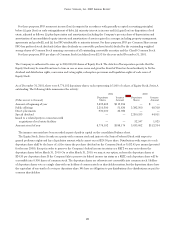

Measurement of Segment Profit or Loss

We evaluate performance and allocate resources based upon the net segment income of each segment. Net segment income

represents net income in conformity with generally accepted accounting principles and our significant accounting policies as

denoted in Note 2, before interest and other income, interest expense, corporate general and administrative expense, and minority

interest in income. The accounting policies of the reportable segments are the same as those described in the Summary of

Significant Accounting Policies.

Interest and other income, interest expense, corporate general and administrative expense, and minority interest in income are

not allocated to segments because management does not utilize them to evaluate the results of operations of each segment.

Measurement of Segment Assets

No segment data relative to assets or liabilities is presented, because we do not evaluate performance based upon the assets or

liabilities of the segments. We believe that the historical cost of the Company’s real property does not have any significant bearing

upon the performance of the commercial property and storage segments. In the same manner, management believes that the book

value of investment in real estate entities has no bearing upon the results of those investments. The only other types of assets that

might be allocated to individual segments are trade receivables, payables, and other assets which arise in the ordinary course of

business, but they are also not a significant factor in the measurement of segment performance. We perform post-acquisition

analysis of various investments; however, such evaluations are beyond the scope of FAS 131.

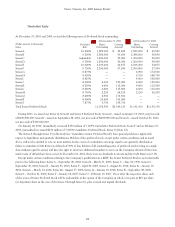

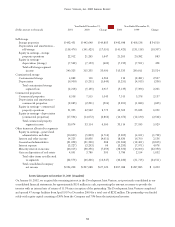

Presentation of Segment Information

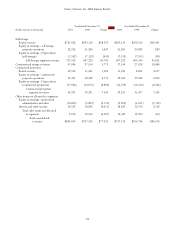

Our income statement provides most of the information required in order to determine the performance of each of the

Company’s three segments. The following tables reconcile the performance of each segment, in terms of segment revenues

and segment income, to our consolidated revenues and net income. It further provides detail of the segment components

of the income statement item, “Equity in earnings of real estate entities.”