Public Storage 2001 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

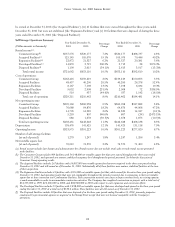

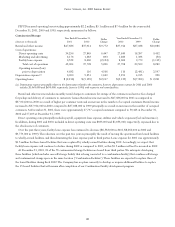

Equity in earnings of PSB represents our pro rata share (approximately 44% at December 31, 2001) of the earnings of PS

Business Parks, Inc., a publicly traded real estate investment trust (American Stock Exchange symbol “PSB”) organized by the

Company on January 2, 1997. As of December 31, 2001, we owned 5,418,273 common shares and 7,305,355 operating

partnership units (units which are convertible into common shares on a one-for-one basis) in PSB. At December 31, 2001,

PSB owned and operated 14.8 million net rentable square feet of commercial space located in nine states. PSB also manages

the commercial properties owned by the Company and affiliated entities.

In April 1997, we formed a joint venture partnership (the “Development Joint Venture”) with an institutional investor to

participate in the development of approximately $220 million of self-storage facilities. The venture is funded solely with equity

capital consisting of 30% from the Company and 70% from the institutional investor. Equity in earnings from the Development

Joint Venture reflects our pro rata share, based upon our ownership interest, of the operations of the Development Joint Venture.

Since inception through December 31, 2000, the Development Joint Venture has developed and opened 47 self-storage facilities

with an aggregate cost of approximately $232 million. Generally the construction period takes nine to 12 months followed by an

estimated 24 month fill-up process until the newly constructed facility reaches a stabilized occupancy level of approximately 90%.

For fiscal 2001, 2000 and 1999, many of the completed facilities were in the fill-up process and had not reached a stabilized

occupancy level.

On January 16, 2002, we purchased the 70% interest from the institutional investor for cash totaling approximately

$155,358,000. As a result of this purchase, effective January 16, 2002, we will no longer account for our ownership of this entity

using the equity method, and accordingly, equity in earnings of real estate investments will be eliminated with respect to this

investment on a go forward basis. Correspondingly, effective January 16, 2002, the rental income, cost of operations and

depreciation expense with respect to these 47 facilities will be reflected in our consolidated statements of income.

Operating results with respect to the “Other investments” includes our pro rata share of earnings with respect to 10 limited

partnerships. These limited partnerships were formed by the Company during the 1980’s. The Company is the general partner in

each limited partnership. The limited partners consist of numerous individual investors, including the Company, which throughout

the 1990’s acquired units of limited partnership interests in these limited partnerships in various transactions.

These 10 limited partnerships own 67 self-storage facilities which are managed by the Company under the “Public Storage”

name. The operating characteristics of these facilities are similar to those of the Company’s self-storage facilities. All 67 of these

self-storage facilities are included in the “Same Store” group of facilities – see Supplemental Property Data and Trends below. See

Note 5 to the consolidated financial statements for further financial information on these partnerships.

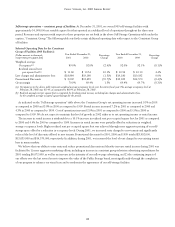

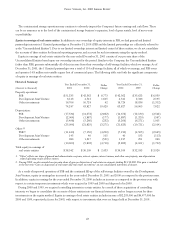

Other Income and Expense Items:

Interest and other income: Interest in other income includes (i) the net operating results from our third party property management

operations, (ii) the net operating results from our merchandise sales and consumer truck rentals and (iii) interest income.

Interest and other income has decreased in 2001 as compared to 2000 principally as a result of lower cash balances invested

in interest bearing accounts, as well as lower interest rates. Interest and other income has increased in 2000 as compared to 1999

principally as a result of higher average cash balances invested in interest bearing accounts. The changes in average cash balances

are primarily due to the timing of investing proceeds from the issuance of equity securities into real estate assets.