Public Storage 2001 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

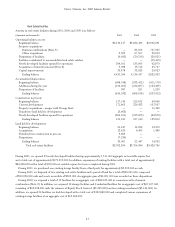

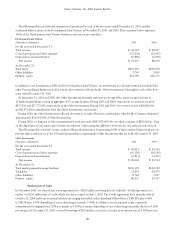

Due to the short period to maturity of our cash and cash equivalents, accounts receivable, and other financial assets included in

other assets, and accrued and other liabilities, the carrying values as presented on the consolidated balance sheets are reasonable

estimates of fair value. The carrying amount of mortgage notes receivable approximates fair value because the applicable interest

rates approximate market rates for these loans. A comparison of the carrying amount of notes payable to their estimated fair value

is included in Note 7, “Notes Payable.”

Financial assets that are exposed to credit risk consist primarily of cash and cash equivalents, accounts receivable, and notes

receivable. Cash and cash equivalents, which consist of short-term investments, including commercial paper, are only invested in

entities with an investment grade rating. Other than the $35,000,000 note receivable from PSB noted above, which was repaid

(unaudited) on January 28, 2002, notes receivable are secured by real estate facilities that we believe are valued in excess of the

related note receivable. Accounts receivable are not a significant portion of total assets and are comprised of a large number of

individual customers.

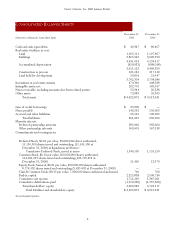

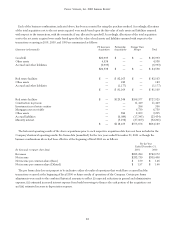

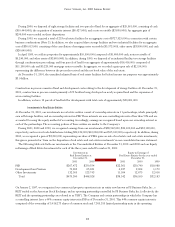

Real Estate Facilities

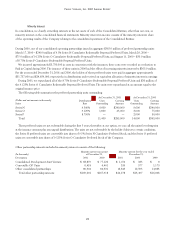

Real estate facilities are recorded at cost. Costs associated with the acquisition, development, construction, and improvement of

properties are capitalized. Interest, property taxes, and other costs associated with development are capitalized as building cost.

Expenditures for repairs and maintenance are charged to expense when incurred. Depreciation is computed using the straight-line

method over the estimated useful lives of the buildings and improvements, which are generally between 5 and 25 years.

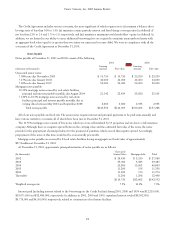

Evaluation of Asset Impairment

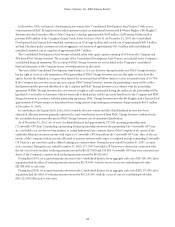

In 1995, the Financial Accounting Standards Board issued Statement No. 121, “Accounting for the Impairment of Long-Lived

Assets and for Long-Lived Assets to be Disposed Of” which requires impairment losses to be recorded on long-lived assets. We

annually evaluate long-lived assets (including intangibles), by identifying indicators of impairment and, if such indicators exist, by

comparing the sum of the estimated undiscounted future cash flows for each asset to the asset’s carrying amount. When indicators

of impairment are present and the sum of the undiscounted cash flows is less than the carrying value of such asset, an impairment

loss is recorded equal to the difference between the asset’s current carrying value and its value based upon discounting its

estimated future cash flows. Statement No. 121 also addresses the accounting for long-lived assets that are expected to be disposed

of. Such assets are to be reported at the lower of their carrying amount or fair value, less cost to sell. Our evaluations have

indicated no impairment in the carrying amount of our assets.

Other Assets

Other assets primarily consist of furniture, fixtures, equipment, and other such assets associated with the containerized storage

business as well as accounts receivable, prepaid expenses, and other such assets of the Company. Included in other assets with

respect to the containerized storage business is furniture, fixtures, and equipment (net of accumulated depreciation) of

$30,699,000 and $28,544,000 at December 31, 2001 and 2000, respectively. Included in depreciation and amortization expense

is $5,851,000, $4,801,000, and $4,915,000 in the years ended December 31, 2001, 2000 and 1999, respectively, of depreciation

of furniture, fixtures, and equipment relating to the containerized storage business.

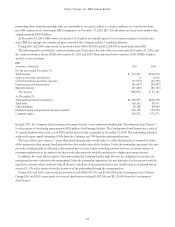

Intangible Assets and Goodwill

Intangible assets consist of property management contracts ($165,000,000 at December 31, 2001 and 2000) and the excess of

acquisition cost over the fair value of net tangible and identifiable intangible assets or “goodwill” ($94,719,000 at December 31,

2001 and $ 67,726,000 at December 31, 2000) acquired in business combinations. Intangible assets are amortized straight-line

over 25 years. At December 31, 2001 and 2000, intangible assets are net of accumulated amortization of $57,018,000 and

$47,709,000, respectively. Included in depreciation and amortization expense is $9,309,000 in each of the three fiscal years

ended December 31, 2001 with respect to the amortization of intangible assets.

Intangible assets and goodwill increased by $26,993,000 in the year ended December 31, 2001 as a result of the acquisition

of PS Insurance Company, Ltd. (See Note 3).