Public Storage 2001 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

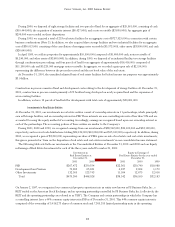

Equity Stock, Series AA

In June 1997, we contributed $22,500,000 (225,000 shares) of Equity Stock, Series AA to a partnership in which the Company is

the general partner. As a result of this contribution, the Company obtained a controlling interest in the partnership and began to

consolidate the accounts of the partnership and therefore the Equity Stock, Series AA and related dividends are eliminated in

consolidation. The Equity Stock, Series AA ranks on a parity with Common Stock and junior to the Senior Preferred Stock with

respect to general preference rights and has a liquidation amount of ten times the amount paid to each Common Share up to

a maximum of $100 per share. Quarterly distributions per share on the Equity Stock, Series AA are equal to the lesser of

(i) 10 times the amount paid per Common Stock or (ii) $2.20. We have no obligation to pay distributions if no distributions

are paid to common shareholders.

Equity Stock, Series AAA

In November 1999, we sold $100,000,000 (4,289,544 shares) of Equity Stock, Series AAA to the Consolidated Development

Joint Venture (Note 8). We control the joint venture and consolidate the accounts of the joint venture, and accordingly the Equity

Stock, Series AAA and related dividends are eliminated in consolidation. The Equity Stock, Series AAA ranks on a parity with

Common Stock and junior to the Senior Preferred Stock with respect to general preference rights, and has a liquidation amount

equal to 120% of the amount distributed to each common share. Annual distributions per share are equal to the lesser of (i) five

times the amount paid per common share or (ii) $2.1564. We have no obligation to pay distributions if no distributions are paid

to common shareholders.

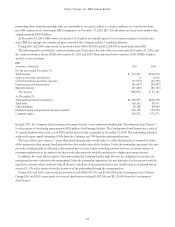

Dividends

On August 9, 2001, the Board of Directors increased the quarterly distribution paid on the Company’s common stock from

$0.22 to $0.45, an increase of $0.23 or 104.5% over the previous quarterly distribution.

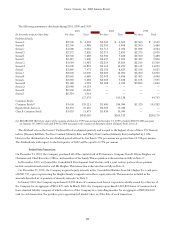

The unaudited characterization of dividends for Federal income tax purposes is made based upon earnings and profits of the

Company, as defined by the Internal Revenue Code. Distributions declared by the Board of Directors (including distributions to

the holders of preferred stock) in 2001 were characterized as follows:

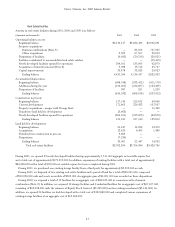

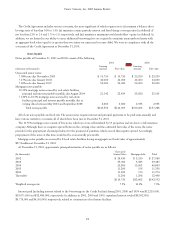

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Ordinary income 96.60% 99.67% 100.00% 100.00%

Long-term Capital Gain 3.40% 0.33% 0.00% 0.00%

Total 100.00% 100.00% 100.00% 100.00%

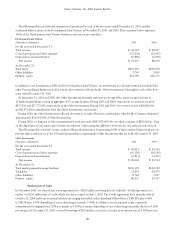

On August 9, 2001, the Board of Directors declared a special distribution to the common shareholders of $0.35 per common

share in cash, which was paid on September 30, 2001. On August 30, 2000, the Board of Directors declared a special distribution

to the common shareholders of $0.60 per common share in cash, which was paid on September 30, 2000. On November 4,

1999, the Board of Directors declared a special distribution to the common shareholders. The special distribution is comprised of

(i) $0.65 per common share payable in depositary shares, representing interests in Equity Stock, Series A, with cash being paid in

lieu of fractional shares or (ii) at the election of each common shareholder, $0.62 per common share payable in cash. The special

distribution was accrued at December 31, 1999, and paid on January 14, 2000 to shareholders of record as of November 15, 1999.