Public Storage 2001 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

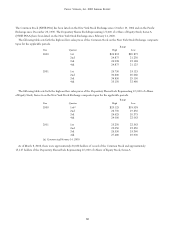

to the holders of our Common Stock, $11.5 million to the holders of our Class B Common Stock and $19.5 million to the holders

of our Equity Stock, Series A. Although we have not finalized the calculation of our 2001 taxable income, we believe that the

aggregate dividends paid in 2001 to our shareholders were designed to enable us to continue to qualify as a REIT.

We estimate that the distribution requirements for fiscal 2002 with respect to our Cumulative Preferred Stock outstanding

(including the Series T and U issued subsequent to December 31, 2001), and assuming the redemption of Cumulative Preferred

Stock, Series A, will be approximately $150.6 million.

During 2001, we paid distributions totaling $31.7 million with respect to our Preferred Partnership Units. We estimate the

annual distributions requirements with respect to the preferred partnership units outstanding at December 31, 2001 to be

approximately $26.9 million.

For 2002, distributions with respect to the Common Stock and Equity Stock, Series A will be determined based upon our REIT

distribution requirements after taking into consideration distributions to the preferred shareholders. We anticipate that, at a

minimum, quarterly distributions per common share will remain at $0.45 per common share (increased from $0.22 per common

share during 2000 and in the first two quarters of 2001). For the first quarter of 2002, a quarterly distribution of $0.45 per

common share has been declared by our Board of Directors. Over the past several years, in addition to the regular quarterly

dividends paid to our common shareholder, we also paid special distributions. These special distributions were necessary to meet

our distribution requirements in order to maintain our REIT tax status. The need to make a special distribution in 2002 is not

determinable at this time and will depend in large part on our 2002 taxable income relative to the distributions being paid to all of

our shareholders.

With respect to the depositary shares of Equity Stock, Series A, we have no obligation to pay distributions if no distributions are

paid to the common shareholders. To the extent that we do pay common distributions in any year, the holders of the depositary

shares receive annual distributions equal to the lesser of (i) five times the per share dividend on the common stock or (ii) $2.45.

The depositary shares are noncumulative, and have no preference over our Common Stock either as to dividends or in liquidation.

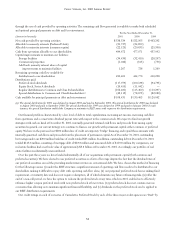

Capital improvement requirements: During 2002, we have budgeted approximately $31 million for capital improvements. Capital

improvements include major repairs or replacements to the facilities which keep the facilities in good operation condition and

maintain their visual appeal. Capital improvements do not include costs relating to the development or expansion of facilities.

Debt service requirements: We do not believe we have any significant refinancing risks with respect to our mortgage debt, all of

which is fixed rate. At December 31, 2001, we had total outstanding notes payable of approximately $143.6 million. See Note 7

to the consolidated financial statements for approximate principal maturities of such borrowings. We anticipate that our retained

operating cash flow will continue to be sufficient to enable us to make scheduled principal payments. It is our current intent to

fully amortize our debt as opposed to refinance debt maturities with additional debt.

Growth strategies: During 2002, we intend to continue to expand our asset and capital base through the acquisition of real estate

assets and interests in real estate assets through direct purchases, mergers, tender offers or other transactions and through the

development of additional storage facilities.

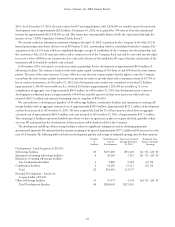

Acquisition and development of facilities: During 2001, we acquired only one self-storage facility for approximately $3.5 million.

During 2000, we acquired two commercial facilities and 12 storage facilities at an aggregate cost of approximately $67.1 million.

Our low level of third party acquisitions over the past two years is not indicative of either the supply of facilities offered for sale

or our ability to finance the acquisitions, but is primarily due to prices sought by sellers and our lack of desire to pay such prices.

During fiscal 2002, we will continue to seek to acquire additional self-storage facilities from third parties, however, it is difficult

to estimate the level of third party acquisitions.

On September 15, 2000, we acquired the remaining ownership interests in an affiliated partnership, of which we were the

general partner, for an aggregate acquisition cost of $81.2 million. This partnership owned 13 self-storage facilities.

In April 1997, we formed a joint venture partnership with an institutional investor for the purpose of developing up to $220.0

million of self-storage facilities. The joint venture is funded solely with equity capital consisting of 30% from us and 70% from the

institutional investor. Our share of the cost of the real estate in the joint venture was approximately $69 million at December 31,