Public Storage 2001 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

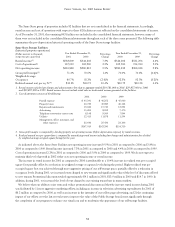

In addition to the above projects, we have 12 parcels of land held for development with total costs of approximately

$30,001,000 at December 31, 2001.

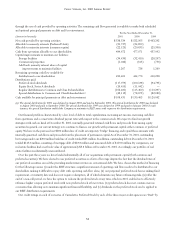

Stock repurchase program: The Company’s Board of Directors has authorized the repurchase from time to time of up to

25,000,000 shares of the Company’s common stock on the open market or in privately negotiated transactions. During 2001, we

repurchased a total of 10,585,593 common shares, for a total aggregate cost of approximately $276.9 million. From the inception

of the repurchase program through December 31, 2001, we have repurchased a total of 21,486,020 shares of common stock at an

aggregate cost of approximately $535.5 million. From January 1, 2002 until March 26, 2002, there were no significant repurchases

of our common stock.

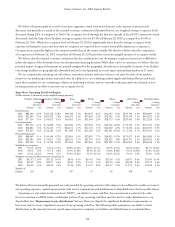

Funds from operations: Total funds from operations (“FFO”) increased to $499.6 million for the year ended 2001 compared

to $452.2 million for the year ended 2000 and $429.0 million in 1999. FFO available to common shareholders (after deducting

preferred stock dividends) increased to $362.1 million for the year ended December 31, 2001 compared to $341.0 million in

2000 and $334.2 million in 1999. FFO means net income (loss) (computed in accordance with generally accepted accounting

principles) before (i) gain (loss) on early extinguishment of debt, (ii) minority interest in income and (iii) gain (loss) on

disposition of real estate, adjusted as follows: (i) plus depreciation and amortization related to real estate assets (including the

Company’s pro-rata share of depreciation and amortization of unconsolidated equity interests and amortization of assets acquired

in a merger, including property management agreements and goodwill), and (ii) less FFO attributable to minority interests.

FFO is a supplemental performance measure for equity REITs as defined by the National Association of Real Estate Investment

Trusts, Inc. (“NAREIT”). The NAREIT definition does not specifically address the treatment of minority interest in the

determination of FFO or the treatment of the amortization of property management agreements and goodwill. In the case of the

Company, FFO represents amounts attributable to its shareholders after deducting amounts attributable to the minority interests

and before deductions for the amortization of property management agreements and goodwill. FFO is presented because

management, as well as many industry analysts, consider FFO to be one measure of the performance of the Company and it is

used in establishing the terms of the Class B Common Stock. FFO does not take into consideration capital improvements,

scheduled principal payments on debt, distributions and other obligations of the Company. Accordingly, FFO is not a substitute for

the Company’s cash flow or net income (as discussed above) as a measure of the Company’s liquidity or operating performance.

FFO is not comparable to similarly entitled items reported by other REITs that do not define it exactly as we have defined it.

Q

UANTITATIVE AND

Q

UALITATIVE

D

ISCLOSURES

A

BOUT

M

ARKET

R

ISK

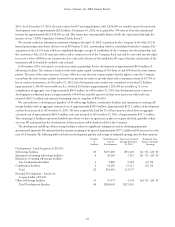

To limit our exposure to market risk, we principally finance our operations and growth with permanent equity capital consisting

either of common or preferred stock. At December 31, 2001, the Company’s debt as a percentage of total shareholders’ equity

(based on book values) was 4.3%.

Our preferred stock is not redeemable at the option of the holders. Except under certain conditions relating to the Company’s

qualification as a REIT, the Senior Preferred Stock is not redeemable by the Company prior to the following dates: Series A –

September 30, 2002, Series B – March 31, 2003, Series C – June 30, 1999, Series D – September 30, 2004, Series E – January 31,

2005, Series F – April 30, 2005, Series J – August 31, 2002, Series K – January 19, 2004, Series L – March 10, 2004, Series M –

August 17, 2004, Series Q – January 19, 2006, Series R – September 28, 2006, Series S – October 31, 2006, Series T – January 18,

2007 and Series U – February 19, 2007. On or after the respective dates, each of the series of Senior Preferred Stock will be

redeemable at the option of the Company, in whole or in part, at $25 per share (or depositary share in the case of the Series J

through Series U), plus accrued and unpaid dividends.

Our market risk sensitive instruments include notes payable, which totaled $168,552,000 at December 31, 2001. All of our

notes payable bear interest at fixed rates. See Note 7 to the consolidated financial statements for terms, valuations and

approximate principal maturities of the notes payable as of December 31, 2001.