Public Storage 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

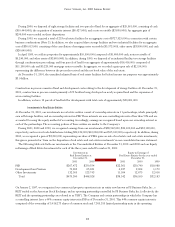

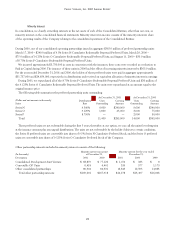

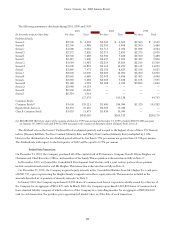

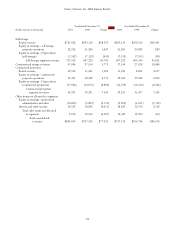

The following summarizes dividends during 2001, 2000 and 1999:

2001 2000 1999

(In thousands, except per share data)

Per share Total Per share Total Per share Total

Preferred Stock:

Series A $2.500 $ 4,563 $2.500 $ 4,563 $2.500 $ 4,563

Series B $2.300 5,488 $2.300 5,488 $2.300 5,488

Series C $1.688 2,024 $1.711 2,052 $1.688 2,024

Series D $2.375 2,850 $2.375 2,850 $2.375 2,850

Series E $2.500 5,488 $2.500 5,488 $2.500 5,488

Series F $2.437 5,606 $2.437 5,606 $2.437 5,606

Series G $1.664 11,482 $2.219 15,309 $2.219 15,309

Series H $1.608 10,853 $2.112 14,259 $2.112 14,259

Series I $1.869 7,475 $2.156 8,625 $2.156 8,625

Series J $2.000 12,000 $2.000 12,000 $2.000 12,000

Series K $2.063 9,488 $2.063 9,488 $1.965 9,040

Series L $2.063 9,488 $2.063 9,488 $1.673 7,695

Series M $2.188 4,922 $2.188 4,922 $0.820 1,846

Series Q $2.048 14,134 ————

Series R $0.500 10,200 ————

Series S $0.334 1,918 ————

117,979 100,138 94,793

Common Stock:

Common Stock

(a)

$1.690 193,121 $1.480 184,084 $1.520 195,383

Equity Stock, Series A $2.450 19,455 $2.363 11,042 — —

Class B Common Stock $1.639 11,475 $1.436 10,049 — —

$342,030 $305,313 $290,176

(a) $82,086,000 ($0.64 per share) of the common dividend in 1999 was accrued at December 31, 1999, of which $38,075,000 was paid

on January 14, 2000 in cash and $44,011,000 was paid in the issuance of depositary shares of Equity Stock, Series A.

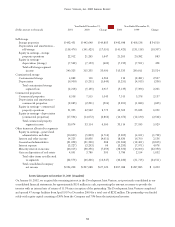

The dividend rate on the Series C Preferred Stock is adjusted quarterly and is equal to the highest of one of three U.S. Treasury

indices (Treasury Bill Rate, Ten Year Constant Maturity Rate, and Thirty Year Constant Maturity Rate) multiplied by 110%.

However, the dividend rate for any dividend period will not be less than 6.75% per annum nor greater than 10.75% per annum.

The dividend rate with respect to the first quarter of 2002 will be equal to 6.75% per annum.

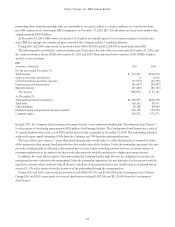

Note 10 — Related Party Transactions

On December 31, 2001, the Company purchased all of the capital stock of PS Insurance Company from B. Wayne Hughes, our

Chairman and Chief Executive Officer, and members of his family. This acquisition is discussed more fully in Note 3.

In November 1999, we formed the Consolidated Development Joint Venture with a joint venture partner whose partners

include an institutional investor and Mr. Hughes. This transaction is discussed more fully in Note 8.

On December 31, 2001, the Company acquired equity interests in the Consolidated Entities from Mr. Hughes for a cash price

of $786,770, a price representing the Hughes family’s original cost in these equity interests. This amount is included in the

amounts described as “acquisition of minority interests” in Note 8.

In January 2001, the Company repurchased 10,000 shares of common stock from a corporation wholly-owned by a director of

the Company for an aggregate of $251,875 cash. In March 2001, the Company repurchased 2,619,893 shares of common stock

from a limited liability company of which a director of the Company is a controlling member for an aggregate of $68,064,820

cash. In each transaction, the purchase price approximated market value as of the date of each transaction.