Public Storage 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

Common Stock

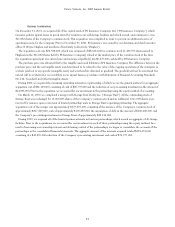

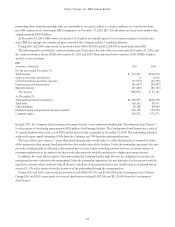

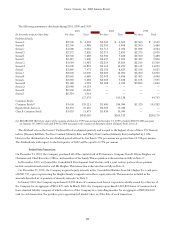

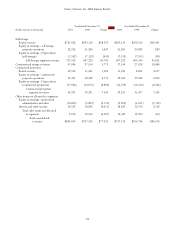

During 2001, 2000 and 1999, we issued and repurchased shares of our common stock as follows:

2001 2000 1999

(Dollar amount in thousands)

Shares Amount Shares Amount Shares Amount

Exercise of stock options 704,901 $ 15,857 242,598 $ 4,608 511,989 $ 10,000

In connection with mergers (Note 3) ————13,009,485 347,223

Conversion of OP Units — — 255,853 6,829 241,071 6,434

Business Combinations

(a)

1,138,733 30,814 — — 1,557,960 40,027

Repurchases of stock

(b)

(10,585,593) (276,861) (3,491,600) (77,799) (4,589,427) (108,565)

(8,741,959) $(230,190) (2,993,149) $(66,362) 10,731,078 $ 295,119

(a) See Note 3 regarding acquisition of PS Insurance Company.

(b) Includes 10,000 shares purchased in January 2001 from a corporation wholly-owned by a director of the Company for an aggregate of

$251,875 cash. Includes 2,619,893 shares purchased in March 2001 from a limited liability company of which a director of the Company

is a controlling member for an aggregate of $68,064,820 in cash. In each transaction, the purchase price approximated market value as of

the date of each transaction.

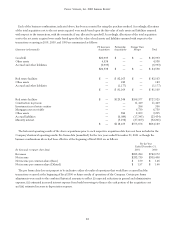

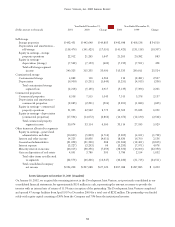

As previously announced, the Board of Directors authorized the repurchase from time to time of up to 10,000,000 shares

of the Company’s common stock on the open market or in privately negotiated transactions. On March 4, 2000, the Board of

Directors increased the authorized number of shares which the Company could repurchase to 15,000,000. On March 15, 2001,

the Board of Directors increased the authorized number of shares the Company could repurchase to 20,000,000. During 2001,

the Board of Directors increased the authorized number of shares the Company could repurchase to 25,000,000. Cumulatively

through December 31, 2001, we repurchased a total of 21,486,020 shares of common stock at an aggregate cost of approximately

$535,481,000.

During 2001, we entered into an arrangement with a financial institution whereby we sold to the institution the right to require

us to purchase from the institution (or, at our option, pay in cash or common stock the differential between the market price and

$26.26 per share) up to 1,000,000 shares of our common stock at a price of $26.26 on certain dates in September 2001 and

October 2001. In exchange for this right, the financial institution paid us $910,000, the amount of which has been reflected

as an increase to our paid-in capital. The right expired without being exercised.

On December 31, 2001, we issued 1,138,733 shares of common stock in connection with the acquisition of PS Insurance

Company (Note 3), representing 1,439,765 shares issued to Hughes less 301,032 shares held by PS Insurance. On March 12,

1999, we issued 13,009,485 shares of common stock pursuant to the merger with Storage Trust Realty.

At December 31, 2001, the Company had 11,240,846 shares of common stock reserved in connection with the Company’s

stock option plans (Note 11), 7,000,000 shares of common stock reserved for the conversion of the Class B Common Stock

and 237,935 shares reserved for the conversion of Convertible OP Units.

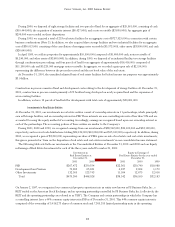

Class B Common Stock

Commencing January 1, 2000, the Class B Common Stock participates in distributions at the rate of 97% of the per share

distributions on the Common Stock, provided that cumulative distributions of at least $0.22 per quarter per share have been paid

on the Common Stock. The Class B Common Stock will (i) not participate in liquidating distributions, (ii) not be entitled to vote

(except as expressly required by California law) and (iii) automatically convert into Common Stock, on a share for share basis,

upon the later to occur of FFO per common share aggregating $3.00 during any period of four consecutive calendar quarters or

January 1, 2003.