Public Storage 2001 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2001 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

P

UBLIC

S

TORAGE

,I

NC

. 2001 A

NNUAL

R

EPORT

We estimate that our net income for 2001 has been impacted negatively as a result of our development activities by approxi-

mately $29,011,000, $17,869,000, and $10,828,000 in the years ended December 31, 2001, 2000, and 1999, respectively,

primarily representing the difference between the revenues of the Developed Facilities and the related costs denoted above. These

amounts include approximately $8,670,000, $4,232,000, and $1,366,000 for the years ended December 31, 2001, 2000, and

1999, respectively, in depreciation expense.

We continue to develop facilities, despite the short-term earnings dilution experienced during the Stabilization Period, because

we believe that the ultimate returns on developed facilities are favorable. In addition, we believe that it is advantageous for us

to continue to expand our asset base and benefit from the resultant increased critical mass, with facilities that will improve our

portfolio’s overall average construction and location quality.

We expect that over at least the next 24 months, the Developed Facilities will continue to have a negative impact to our

earnings. Furthermore, the 46 facilities in our development pipeline described in “Liquidity and Capital Resources – Acquisition

and Development of Facilities” that will be opened for operation over the next 12-24 months will also negatively impact our

earnings until they reach a stabilized occupancy level.

Self-storage operations – disposed facilities: During the three-year period ended December 31, 2001, we disposed of 18 facilities.

No further operations will be reflected on the Company’s financial statements after December 31, 2001 with respect

to these facilities. These properties consisted primarily of facilities condemned by governmental agencies or acquired in the

Storage Trust merger that were not deemed compatible with the Company’s operations.

Commercial property operations: Commercial property operations included in the consolidated financial statements include

commercial space owned by the Company and Consolidated Entities. We have a much larger interest in commercial properties

through ownership interest in PSB. Our investment in PSB is accounted for on the equity method of accounting, and accordingly

our share of PSB’s earnings is reflected as “Equity in earnings of real estate entities”, see below.

During 2000, we acquired two commercial facilities (which were anticipated to be converted to storage facilities) for an

aggregate cost of $5,930,000. Included within commercial property operations for 2000 with respect to these facilities was

revenues of $475,000 and cost of operations of $131,000; included within commercial properties operations for 2001 with

respect to these facilities were revenues of $670,000 and cost of operations of $243,000.

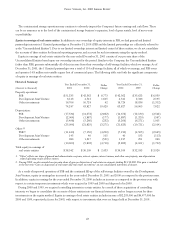

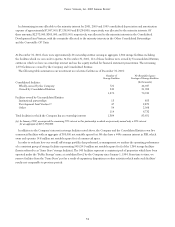

The following table sets forth the historical commercial property amounts included in the financial statements:

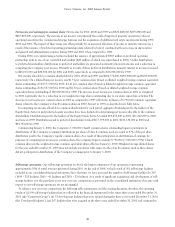

Commercial Property Operations:

Year Ended December 31, Year Ended December 31,

(Amounts in thousands)

2001 2000 Change 2000 1999 Change

Rental income $12,530 $11,341 10.5% $11,341 $8,204 38.2%

Cost of operations 3,972 3,826 3.8% 3,826 2,826 35.4%

Net operating income 8,558 7,515 13.9% 7,515 5,378 39.7%

Depreciation expense 2,685 2,291 17.2% 2,291 1,686 35.9%

Operating income $ 5,873 $ 5,224 12.4% $ 5,224 $3,692 41.5%

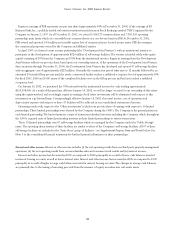

Containerized storage operations: In August 1996, Public Storage Pickup & Delivery (“PSPUD”), a subsidiary of the Company,

made its initial entry into the containerized storage business through its acquisition of a single facility operator located in Irvine,

California. At December 31, 2001, PSPUD operated 55 facilities in 14 states. The facilities are located in major markets in which

we have significant market presence with respect to our traditional self-storage facilities.